In Africa, mobile money has revolutionized consumer payments, bill payments, remittances, and consumer-to-business transactions, making financial services more accessible.

However, the challenges of digitizing business-to-business (B2B) transactions are far more complex. Despite its convenience, mobile money often struggles to meet the sophisticated demands of businesses that require more than just simple, real-time payments.

If someone asks why we can not meaningfully digitise business-to-business payments with mobile money, the one-liner is, “Mobile money was never built for businesses.” In this article, I will explain further with realistic examples from East Africa.

B2B payments refer to business transactions, such as when a driver pays for fuel using a company fuel card, a retailer pays Coca-Cola for beverage supplies, a restaurant pays EA Fruits for produce, or an importer settles payments with exporters for goods.

These transactions typically involve larger sums, complex invoicing, and more stringent tracking requirements than consumer payments. The need for innovation to tackle challenges within B2B payments in Africa is significant.

Example: Consider a transporter who charges a flat $100 per container delivery at any of their 15 warehouses. With annual collections of about $50 million, Tembo a fintech, deployed an integrated digital payment solution, charging a 1.5% fee per transaction.

Mpesa, however, adds a $1.50 sending fee, and we charge a $1.50 collection fee, totalling $3 per transaction. Going digital, then, costs the customer $1,500,000 annually—3% of their total revenue.

This makes the switch to digital payments an expensive proposition, highlighting why mobile money remains a difficult choice for digitizing B2B payments.

Based on our experience living in mobile money markets, building fintech solutions with banks and working directly with mobile money in Africa, Here’s why digitizing B2B transactions via mobile money is difficult:

1. Scaling Up for Larger, More Complex Transactions

B2B transactions typically involve much larger sums and more intricate payment terms, like credit periods, instalment payments, and bulk orders. Mobile money platforms are optimized for small, real-time transactions, making them ill-suited for handling the larger amounts and complex payment structures businesses require.

Example: A manufacturing company needing to pay $250,000 for raw materials often requires staggered payments and credit terms. Mobile money’s transaction limits and inability to manage deferred payments make it an unattractive option, pushing businesses toward bank transfers that can handle high-value transactions.

2. Limited Integration with Businesses

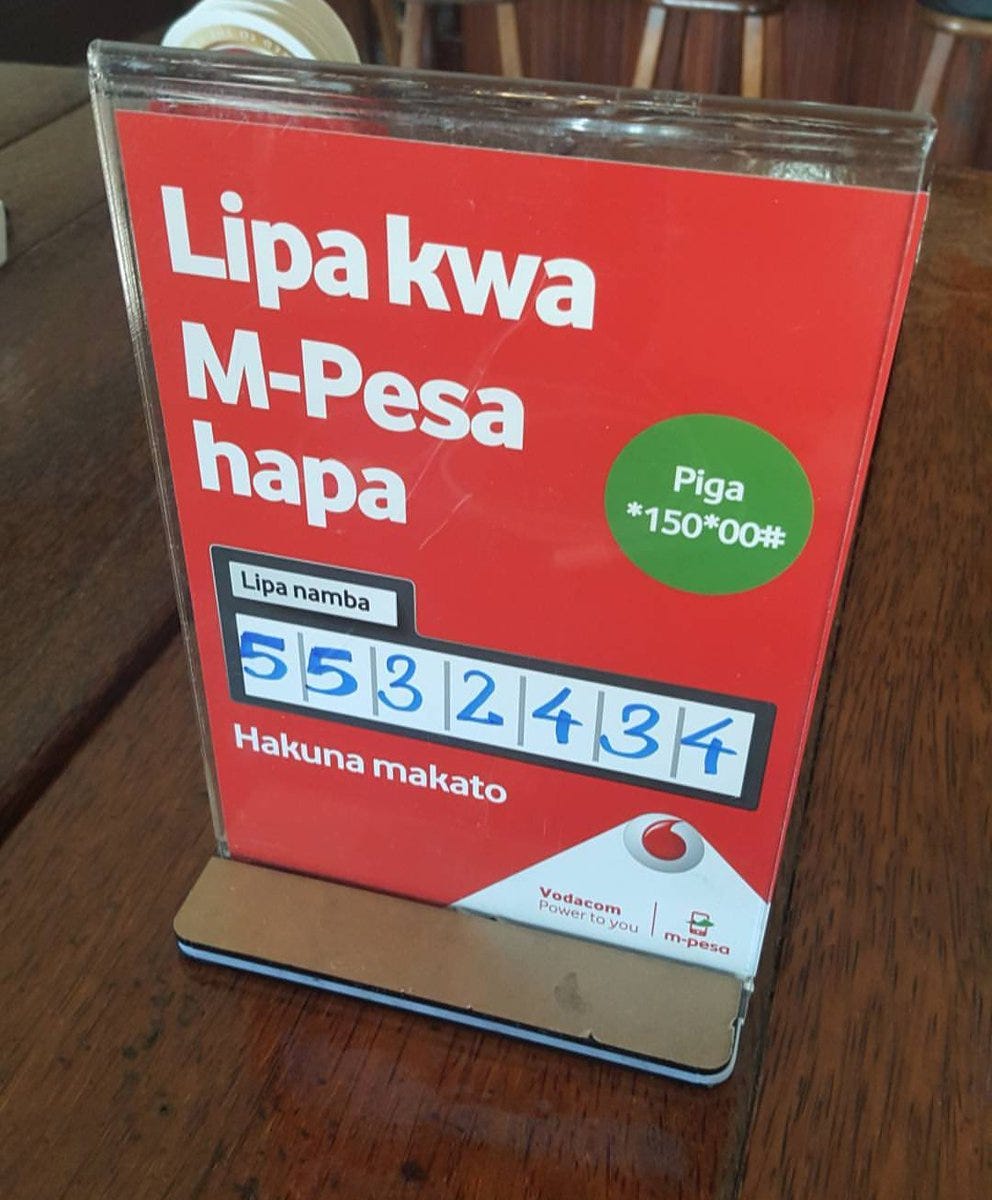

Unbelievably LipaNamba which is a very successful offline merchant pay solution by Mobile money operators has no API for Businesses and the mobile money operators have proven that they are not able to seriously custom-build solutions like the way fintech would.

Businesses rely on ERP systems, accounting software, and inventory management tools to streamline operations. Mobile money platforms typically lack deep integration capabilities with these systems, forcing businesses to rely on manual reconciliation. This disconnect makes it challenging to digitize payments without disrupting workflows.

Example: A wholesaler using an ERP system like Microsoft requires payment solutions that integrate directly into their software for automated processing.

Mobile money often can’t provide this level of integration, so businesses continue using bank accounts that sync seamlessly with their systems.

3. High Charges and Fees

Based on their original business model, Mobile money platforms often come with transaction fees on both the sending and receiving sides, which can quickly add up, especially for large B2B transactions.

These fees make mobile money less attractive compared to bank transfers, which often offer lower charges for bulk payments.

Example: A construction firm making a $150,000 payment might face a significant fee on mobile money platforms—charged for both sending and receiving the payment.

4. Stringent Regulatory Requirements

B2B payments are subject to stricter regulatory oversight, including KYC, AML, and tax compliance regulations. Mobile money platforms, designed for consumer transactions, often struggle to meet these more rigorous regulatory demands.

This complexity increases the difficulty of onboarding businesses and ensuring compliance, creating a significant barrier to digitizing B2B payments via mobile money.

Example: An exporter dealing with international clients must adhere to strict AML and KYC regulations. Mobile money platforms, built for low-value transactions, may lack the compliance infrastructure to handle these complex regulatory requirements, forcing the exporter to rely on traditional banking systems.

5. Security and Trust Issues

The lack of comprehensive security features and dispute-resolution processes makes businesses hesitant to digitize payments through mobile money.

Example: A logistics company making payments of $200,000 needs high-level security and reliable dispute-resolution mechanisms in case something goes wrong.

6. Cross-Border and Currency Limitations

Many businesses operate across borders, requiring payment systems that handle multiple currencies and complex international transactions.

Mobile money platforms are often limited to domestic markets and may not offer the interoperability needed for cross-border B2B transactions, making them less attractive for global businesses.

Example: A business exporting to Kenya needs a payment system that supports different currencies and can handle uploading supporting documents.

7. Liquidity Constraints

Liquidity is crucial for businesses, especially when managing large transactions. Mobile money platforms often impose transaction limits and face liquidity challenges, making it difficult for businesses to access and move large sums of money quickly. This limitation makes digitizing B2B transactions through mobile money platforms impractical.

8. Cultural Resistance to Change

Many businesses are comfortable with traditional payment methods like bank transfers, checks, and cash. Convincing businesses to shift to mobile money involves overcoming deep-seated habits and addressing reliability, security, and scalability concerns. This cultural resistance slows the adoption of mobile money for B2B transactions.

Conclusion

While mobile money has successfully digitized consumer payments, the complexities of B2B transactions present unique challenges. Larger amounts, complex business needs, regulatory pressures, high fees, and limited integration create significant barriers.

Until mobile money platforms evolve to address these issues—offering better integration, lower fees, enhanced security, and seamless cross-border capabilities—digitizing B2B payments will remain a difficult task. Traditional banking channels will continue to dominate the B2B space, as they are able to handle these complexities.

Did you learn anything from this article? What do you think is wrong with our line of thinking? Tell us more about how you felt about this material. We would love to learn.