With the launch of the new central bank digital currency (CBDC), Tanzania’s digital currency revolution is underway. Tanzania’s digital currency is expected to impact the Tanzanian economy and society significantly and offer several advantages for everyday transactions. Will the launches of this new central bank digital currency in Tanzania bring any changes? Are the majorities familiar with this? How will it help them in their day-to-day transactions and payments?

In a notice issued on January 14, 2023, the Bank of Tanzania (BOT) announced its ongoing research and exploration into the potential issuance of a Central Bank Digital Currency (CBDC). To spearhead this initiative, the BOT has established a multidisciplinary technical team tasked with examining the practical aspects of CBDCs.

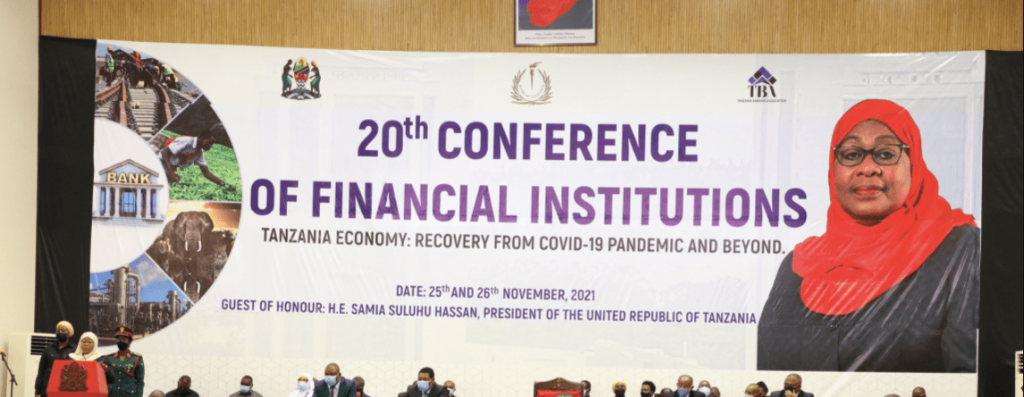

In line with its commitment to exploring innovative financial solutions, the BOT organized the 20th Conference of Financial Institutions in Tanzania in 2021, focusing on CBDCs and crypto assets. Additionally, the BOT has engaged in discussions with various stakeholders to gather their insights and perspectives on CBDCs.

The BOT’s research indicates that over 100 countries worldwide are at various stages of CBDC adoption. Of these, 88 are in the research phase, 20 are undergoing proof-of-concept testing, 13 are in the pilot stage, and three have officially launched their CBDCs.

The BOT’s ongoing research phase aims to identify a suitable approach for implementing a CBDC that aligns with the unique context of the Tanzanian economy. Adopting this comprehensive approach will ensure that Tanzania’s CBDC effectively addresses the country’s financial needs and promotes inclusive economic growth.

What is The Central Bank’s Digital Currency (CBDC)?

The CBDC is a central bank digital currency (CBDC), a digital form of a country’s fiat currency issued and regulated by the central bank. CBDCs are still in their early stages of development, but they can potentially transform the financial sector and how we make payments. The CBDC is expected to impact the Tanzanian economy and society significantly.

It is expected to boost financial inclusion, reduce the cost of transactions, and increase the efficiency of the payment system. The CBDC could also help to promote economic growth and innovation. However, some questions remain about the CBDC, such as its familiarity among the population and its implications for everyday transactions. This article will explore these questions and provide a detailed analysis of the potential impact of the CBDC on the Tanzanian economy and society.

Familiarity and Implications for Everyday Transactions

One of the critical questions about the CBDC is its familiarity among the population. It is important to note that the CBDC is still in its early stages of development, and it is not yet clear how widely it will be used. One of the key challenges to adopting the CBDC is the lack of access to smartphones and the internet in Tanzania. According to the World Bank, less than 50% of Tanzanians had access to the internet in 2021. This means that a significant portion of the population cannot use the CBDC for everyday transactions.

Another challenge is educating the public about the CBDC and its benefits. Many Tanzanians may not be familiar with the concept of digital currencies, and they may be hesitant to use them. The government and the Bank of Tanzania will need to continue to raise awareness and promote the adoption of the CBDC.

Despite these challenges, the CBDC can potentially revolutionize the Tanzanian financial system. It could make it easier for people to access and use financial services, reduce transaction costs, and promote financial stability. The CBDC could offer several advantages for everyday transactions, such as convenience, security, and affordability. It will be interesting to see how the CBDC develops in the coming years. It could significantly impact the Tanzanian economy and society if widely adopted.

Potential Impact of the CBDC

The potential impact of the Tanzanian Shilling Digital Currency (CBDC) on the Tanzanian economy is significant. The CBDC can revolutionize how Tanzanians pay, transact, and boost economic growth.

Monetary Policy: The CBDC could give the Tanzanian central bank more control over the money supply and inflation. This is because the central bank could directly issue and manage the CBDC without going through commercial banks. This could help to stabilize the Tanzanian shilling and make it more attractive to foreign investors.

Financial Inclusion: The CBDC could also help to promote financial inclusion in Tanzania. Currently, around 40% of Tanzanians are unbanked, meaning they do not have access to formal financial services. The CBDC could make it easier and cheaper for Tanzanians to access financial services, such as savings, loans, and payments. This could help to reduce poverty and inequality and boost economic growth.

Economic Growth: The CBDC could also boost economic growth in Tanzania. This is because the CBDC could make it easier and faster for businesses to transact with each other and consumers. This could lead to increased investment and job creation.

Reshaping the Financial Landscape: The CBDC will likely reshape Tanzania’s traditional financial landscape and banking systems. Commercial banks will need to adapt to the new digital currency environment. They will need to offer new products and services that meet the needs of CBDC users. The CBDC could reshape the traditional financial landscape and banking systems in Tanzania in several ways, including:

Reduced reliance on cash: The CBDC could significantly reduce the use of money in Tanzania. This could have some benefits, such as reducing the cost of printing and distributing cash, making it easier to track financial transactions, and reducing the crime risk.

Increased competition in the financial sector: The CBDC could make it easier for new entrants to compete in the financial industry. This could lead to lower fees and more innovative consumer products and services.

New financial services: The CBDC could enable new financial services, such as micropayments and programmable money. This could make it easier for people to access financial services and participate in the economy.

The Significance of Central Bank Support for the CBDC

Central bank support is essential for the success of the CBDC. The central bank needs to play a leading role in promoting the use of the CBDC and ensuring that it is safe and reliable. It must also work with the private sector to develop the necessary infrastructure and applications to support the CBDC.

The central bank can promote the use of the CBDC by educating the public about its benefits and by working with merchants to make it easier for them to accept the CBDC. The central bank can also ensure that the CBDC is safe and reliable by developing appropriate regulatory and supervisory frameworks.

The central bank can work with the private sector to develop the necessary infrastructure and applications to support the CBDC by providing funding for research and development and by working with financial institutions to create new products and services.

Building Public Trust and Confidence in the CBDC

Many challenges must be addressed to build public trust and confidence in the CBDC. One challenge is the lack of awareness and understanding of the CBDC among the Tanzanian public. The Bank of Tanzania and other stakeholders need to do more to educate the public about the CBDC and how it works.

Another challenge is ensuring the CBDC is accessible and affordable for all Tanzanians. The Bank of Tanzania must ensure that the CBDC is available through various channels, such as mobile phones and banks. Additionally, the Bank of Tanzania needs to ensure that the fees associated with using the CBDC are affordable for all Tanzanians.

Finally, it is essential to address the security concerns that some Tanzanians may have about using the CBDC. The Bank of Tanzania must implement robust security measures to protect the CBDC from cyber-attacks and other threats.

Despite the challenges, there are opportunities to build public trust and confidence in the CBDC. One opportunity is to educate the public about the benefits of the CBDC. For example, the CBDC can help to reduce the cost of financial transactions and make it easier for Tanzanians to send and receive money. Additionally, the CBDC can help to promote financial inclusion and make it easier for all Tanzanians to access financial services.

Another opportunity is to pilot the CBDC with a small group of users before launching it to the general public. This will allow the Bank of Tanzania to identify and address any potential problems with the CBDC before it is widely used.

Everyday Transaction Advantages of Using CBDC

One of the most significant advantages of using CBDCs is their convenience. CBDCs can make payments instantly and securely without intermediaries like banks or credit card companies. This can be especially beneficial for people living in countries with poor financial infrastructure or who need to pay for people in other countries.

For example, a person in Tanzania could use a CBDC to send money to their family in Kenya instantly and securely without paying high fees for a money transfer service. Or, a business in Tanzania could use a CBDC to pay its suppliers in China without worrying about currency exchange rates or transaction fees.

Another advantage of using CBDCs is that they are very secure. CBDCs are backed by the central bank and are as safe as fiat currency. Additionally, CBDCs can use cutting-edge security technologies to protect users’ funds from theft and fraud. For example, a CBDC could use blockchain technology to create a tamper-proof record of all transactions. This would make it very difficult for criminals to steal CBDCs or counterfeit them.

CBDCs can also be very efficient. CBDCs can be processed faster than traditional fiat currencies, leading to significant cost savings for businesses and consumers. For instance, a business could use a CBDC to pay its employees instantly without waiting for a bank to process the payments. This could free up the business’s time and resources to focus on other things.

As more and more central banks launch their CBDCs, we will likely see more and more people using them to make everyday payments.

Finally, engaging with the public and listening to their concerns about the CBDC is essential. The Bank of Tanzania should establish a feedback mechanism so Tanzanians can share their thoughts and suggestions about the CBDC. By addressing the challenges and seizing the opportunities, the Bank of Tanzania can build public trust and confidence in the CBDC and make it a success.

Read A Promise & Peril of Digital Currency Revolution in Sub-Saharan Africa concerning the topic of Digital Currency.