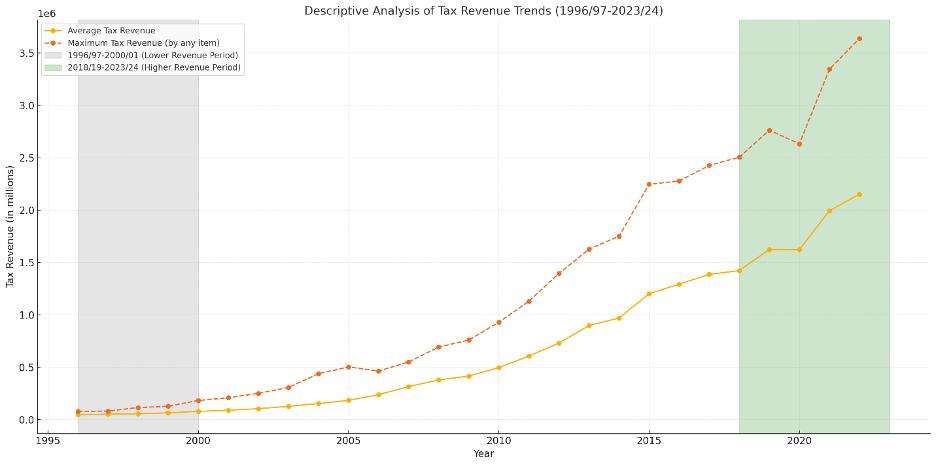

The descriptive analysis of the tax data provides insights into the trends and variations in tax revenue over time. The dataset includes various tax items and their corresponding annual revenues from 1996/97 to 2023/24. The count values indicate the number of tax items recorded for each year, with slight variations across the dataset. This suggests that not all tax items had complete data for every year. The mean values reveal a steady increase in revenue collection over the years, reflecting growth in overall tax performance. Notably, the revenue figures rise significantly in the later years, demonstrating improved tax collection mechanisms or economic expansion.

In earlier years, such as 1996/97 through 2000/01, the average tax revenue was significantly lower compared to later years, staying within a few hundred thousand units. By contrast, revenues in the more recent years, such as 2018/19 to 2023/24, have risen dramatically, reaching several million units on average. This indicates a substantial shift in tax collection efficiency or changes in economic activity, such as increased industrial output or broader tax bases. The transition from lower to higher average revenues reflects the progressive strengthening of the tax system over time.

The descriptive statistics also show variability in tax item contributions, as evidenced by the range of values for each year. While some tax items consistently contribute large amounts, others have lower or more fluctuating revenues, indicating differing levels of dependence on various tax sources. Additionally, the dataset’s steady upward trend in mean values aligns with observed economic growth patterns and suggests that factors like industrialization, policy changes, or improved administrative capabilities have played significant roles in enhancing tax revenue performance. This highlights the importance of continued focus on key economic drivers such as manufacturing and income growth to sustain this upward trajectory.

Trend Analysis

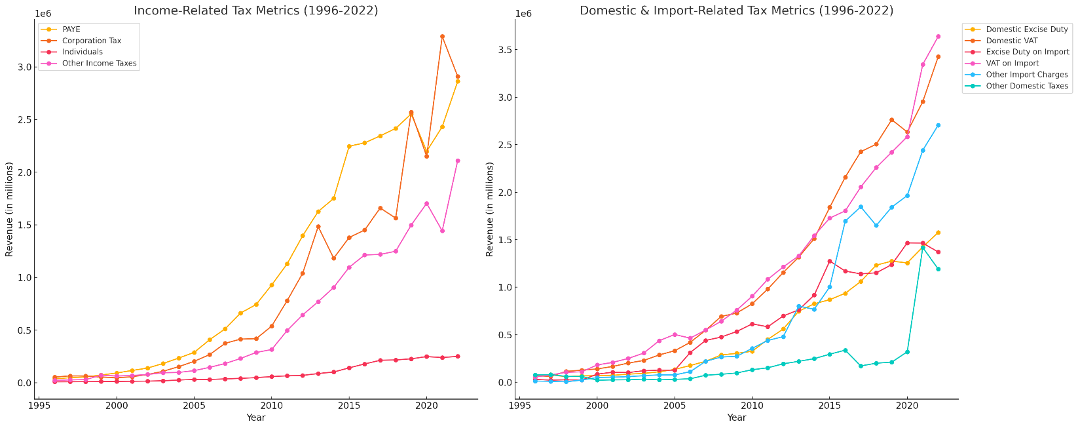

The trends observed in the tax metrics provide valuable insights into the economic and fiscal dynamics of the Tanzanian mainland from 1996 to 2022. Income-related taxes, including PAYE (Pay-As-You-Earn), Corporation Tax, Individuals Tax, and Other Income Taxes, exhibit steady growth, with PAYE standing out as a consistent performer. This growth indicates increasing formal employment and rising wages, alongside improvements in tax compliance. While Corporation Tax shows an overall upward trajectory, its fluctuations suggest sensitivity to corporate profitability, economic cycles, and policy changes. The steady rise in Individuals Tax points to an expanding taxpayer base or enhanced reporting and collection systems. However, variability in Other Income Taxes highlights the less predictable nature of revenues from certain income streams or the impact of occasional policy interventions.

Domestic and import-related taxes also display significant growth, emphasizing their critical role in the tax system. Domestic VAT and Excise Duty exhibit robust increases, driven by rising domestic consumption and effective tax enforcement. Similarly, Import VAT and Excise Duty show consistent upward trends, reflecting expanding trade volumes and improved taxation of imports. Among these, VAT (both domestic and import) emerges as a cornerstone of the tax structure, indicating the broad application of VAT to a wide range of goods and services. However, categories like Other Import Charges and Other Domestic Taxes play a smaller, more variable role in revenue generation.

Tax Contributor Analysis

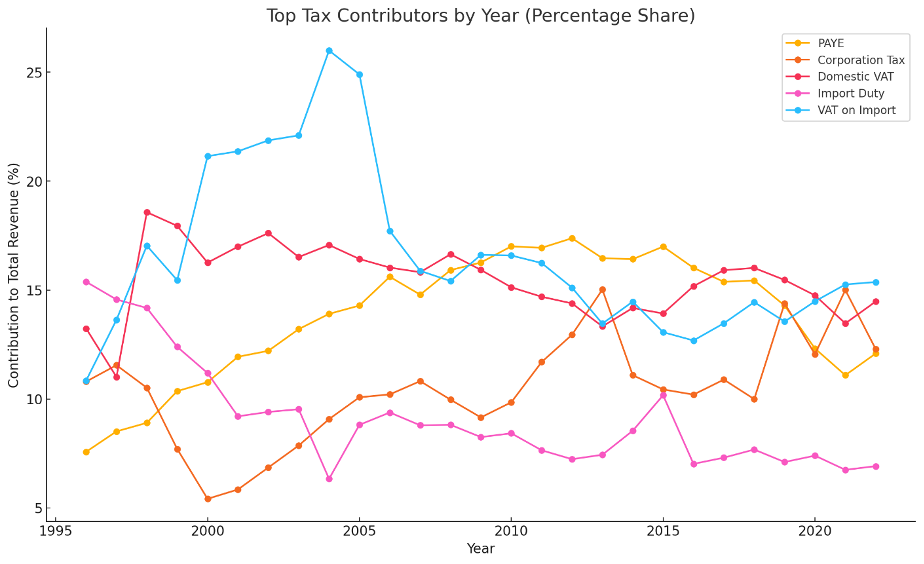

The analysis of top tax contributors over the years highlights the evolving dynamics of tax revenue sources in Tanzania. PAYE (Pay-As-You-Earn) consistently emerges as a significant contributor, reflecting the growing formal employment sector and reliable tax collection from salaried individuals. Corporation Tax also plays a key role, although its contributions exhibit fluctuations, likely influenced by corporate profitability, economic cycles, and tax policy changes. Together, these income-based taxes underscore the importance of economic growth and structured tax compliance in maintaining robust revenue streams.

Consumption-based taxes, particularly Domestic VAT and VAT on Import, have shown notable growth over time, indicating their increasing relevance in the tax system. Domestic VAT’s steady rise reflects expanded domestic consumption and effective VAT enforcement, while VAT on Import highlights the growing reliance on international trade as a revenue driver. Both categories point to the role of consumption taxes in capturing value from economic activities.

Import Duty, while stable, remains a vital contributor, reflecting consistent trade volumes and a relatively fixed tariff structure. These trends collectively underline the diverse and shifting contributions of income, consumption, and trade-based taxes to the national revenue. The analysis emphasizes the need for balanced policy approaches to sustain and enhance these revenue streams, ensuring resilience against economic fluctuations and supporting long-term fiscal stability.

Tax Refund Analysis

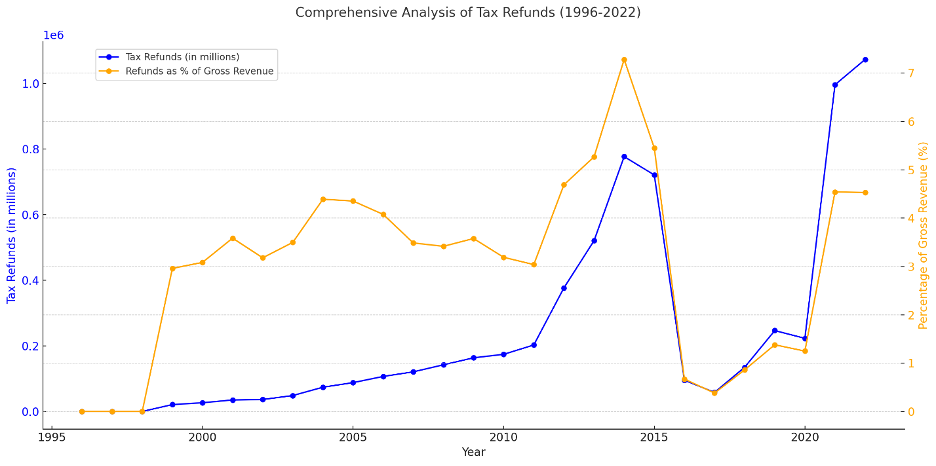

The trend analysis of tax refunds from 1996 to 2022 reveals a steady increase in absolute tax refunds over time, reflecting the growing volume and complexity of tax transactions in an expanding economy. This upward trend is likely tied to higher overall tax collections, as larger provisional payments or overpayments necessitate subsequent adjustments. Additionally, the increase could signify improvements in administrative efficiency, allowing tax authorities to process refunds more effectively.

When examining tax refunds as a percentage of gross revenue, the data shows a relatively stable trend with occasional spikes. This proportional stability suggests that overpayments and corrections remain consistent relative to total revenue collection efforts, indicating effective administrative controls. Periodic spikes in the refund percentage may correspond to policy changes, such as the introduction of new tax incentives, rebates, or adjustments resulting from audits and compliance measures.

Tax Elasticity

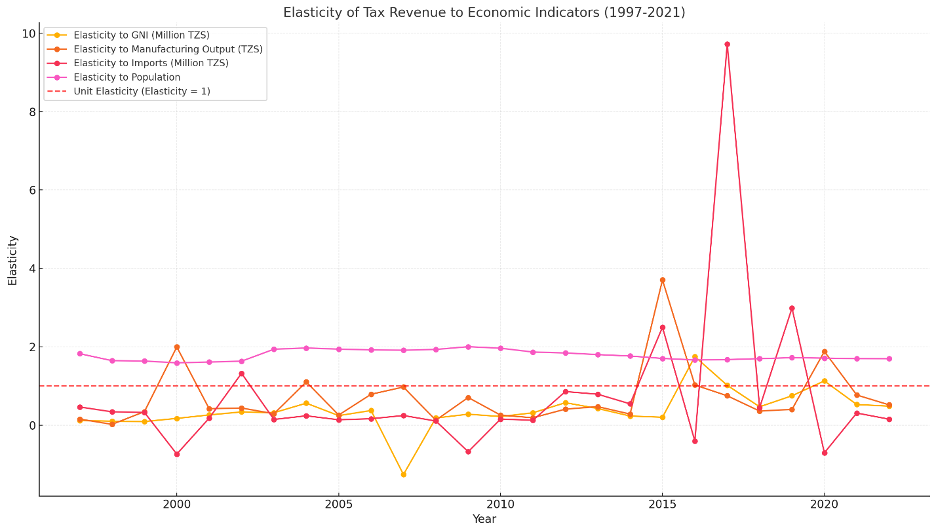

The elasticity analysis highlights varying responsiveness of tax revenue to key economic indicators. Tax revenue shows low but stable elasticity to Gross National Income (GNI), growing slower than income, indicating a limited capture of income growth due to structural inefficiencies. Elasticity to Manufacturing Output is highly variable, reflecting uneven industrial contributions driven by policy or economic shifts. Revenue responds modestly to Imports, signaling the importance of trade taxes, though efficiency improvements could boost responsiveness.

In contrast, tax revenue demonstrates consistently high elasticity to Population, growing faster than population size, suggesting improved per capita collection and a broadening tax base. This trend underscores progress in tax system modernization, as indirect taxes like VAT, consumption taxes, and trade duties capture population-driven economic activities more effectively. Population growth often expands the tax base by increasing consumption and enabling better administrative enforcement, particularly with urbanization and formal employment growth.

The contrasting elasticity responses to GNI and population reveal structural priorities within the tax system. While population-driven consumption enhances tax revenue, limited responsiveness to GNI suggests inefficiencies in income tax collection, possibly due to reliance on indirect taxes, weak enforcement in informal sectors, and insufficient taxation of high-income groups. Addressing these gaps, particularly in income and industrial tax responsiveness, could complement the strong performance tied to population growth and further strengthen overall tax system efficiency.

End Note

The analysis underscores substantial progress in tax revenue collection, supported by economic growth and enhanced administrative systems, while highlighting critical areas for improvement. Key challenges include the low responsiveness of revenue to GNI and fluctuations in sectoral contributions, particularly from manufacturing and corporate taxation, which emphasize the need for structural reforms. Upcoming articles will present actionable strategies to enhance income tax efficiency, stabilize sectoral contributions, and harness economic growth to ensure sustainable and equitable revenue generation. Stay Tuned.

Read more Tax reviews by Kelvin Msangi