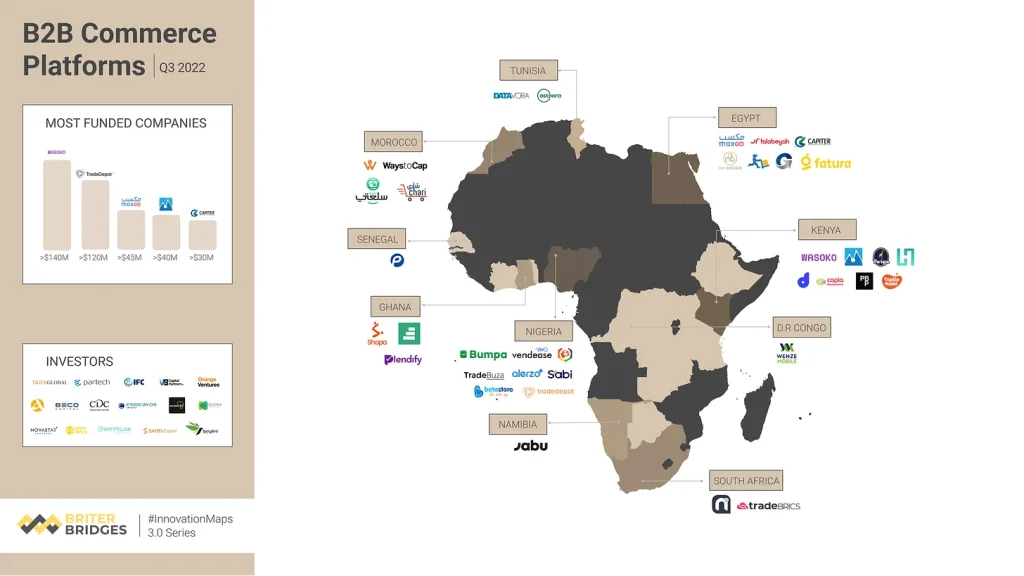

I previously wrote and highlighted the topic of e-commerce in-depth on August 27, 2024, focusing on The Decline and Revival of B2B E-commerce in East Africa. Between 2018 and 2022, East Africa received a major influx of venture capital into the B2B e-commerce space. Let me define the sector as any company using digital methods to facilitate transactions between manufacturers/wholesalers/importers and retail shops who sell directly to final consumers.

More than 350 million USD in VC funding was poured in across several different B2B startups including Twiga Foods, Wasoko, Copia, Marketforce and others under a seeming growth-at-all-costs multi-market mandate.

Perhaps this makes sense from a VC perspective to capture the space with a few category kings across the region and then IPO or otherwise exit. But from an operational perspective, such a strategy is difficult, if not impossible, to execute given the market reality for two key reasons:

- Pure-play B2B e-commerce is a difficult business in developed markets, in emerging markets it faces an even greater challenge given notoriously thin margins, poor infrastructure and long-standing informal market players. In each market, you must carefully consider services that are adjacent to e-commerce, whether it be payments, logistics, or something else, by which you can diversify your risk and generate non-trading revenue. In other words, you need at least a double-play and it may not be the same double-play in each market.

- Each country’s market is unique with material nuances that fundamentally impact the underlying business model across logistics, last mile delivery, payments, local informal market competition and other areas, making a one-size-fits all approach ineffective in capturing real long-term customers.

- Capturing value in each market will likely require some behavior change on the part of the customer, something that never happens quickly. You must build over time for the long term.

Neither of these two points can be meaningfully addressed by a blitz-scale approach turbo-charged by copious amounts of VC dollars. I have been making this argument since early 2020.

What does seem to work in B2B ecommerce is building long term value step by step via carefully calibrated value propositions to segmented customer bases. In other words, building a real business over time where price competition is not the key driver of customer acquisition.

Long-Term Value Vs Short Term Illusions

Building long-term value via e-commerce requires understanding what aspects of the supply chain can be improved via technology and identifying what market segments empirically demonstrate that they are willing to pay for that value.

Digitizing an order is not enough, the digitalization of the order must yield capturable value otherwise not possible via an order placed by a phone call or via a street sales operation, or your business will eventually succumb to the informal market.

If there is no material difference (other than price) for the customer between ordering from you or from the local informal wholesaler, you will lose that battle nine times out of ten.

No one cares about your app or your tech, your fancy college degree or your VC raise, the retail shop owner only cares if they can run their business better or make more money working with you than with someone else.

Value in e-commerce must be tested and discovered market by market. If you attempt to scale rapid growth without a clear, tested, and validated value proposition, you quickly end up in a race to the bottom on price. In fact, VC dollars end up as a short-term subsidy for local retailers.

In other words, retailers will take your discounts when you give them, in order so you can demonstrate market share to your investors, and then go right back to their old supply chain when you don’t because there no material difference in ordering from you or from an informal wholesaler.

If price competition is your only differentiation, most customers will leave as soon as you try to fix your unit economics. The local informal alternative is undefeated when it comes to bargain basement pricing. They can avoid taxes, regulations, and other important rules that VC-backed companies cannot – or should not.

Measured Growth and Unit Economics

The African market reality requires measured growth based on value creation predicated on behavior change on the part of consumers – something that rarely happens overnight.

Keep in mind, the African informal B2B commerce market is several decades in the making, forged by generation-long relationships rooted in value capture by various actors that may have nothing to do with the efficient, modern distribution of goods.

Also, read: Startup Success Secrets: My Mentorship Journey and What African Hubs Must Do Differently

Certain purchasing decisions won’t make sense because informal business is about profit maximization at the individual level at every transaction, not long-term business development. Informal market players are not looking to build a company to exit via IPO or acquisition; they are trying to buy a new car, curry favor with a local politician, or get their children married.

Furthermore, markets can vary drastically from region to region. For example, in Tanzania, there are no established global chain retailers such as Tesco or Carrefour, and this is not because of a lack of trying.

At the same time, in Kenya this is not the case where there are several established players including Naivas, Quickmart and CarreFour. Any strategy to address the two markets must be varied based on their local realities.

Within these varying, competing market realities, B2B e-commerce operators must find ways to grow revenues across specific profitable market segments that have positive unit economics when factoring in your cost basis will be higher than your informal competitor.

Given the lack of disposable income, the vast majority of B2B e-commerce is daily consumables, or the FMCG (fast moving consumer goods) such as beverages, packaged foods, personal care products and other frequent use items. This includes basic food commodities such as flour, sugar and oil.

One trap some B2B ecommerce players fell into was trading in high value commodity goods with very low margins. This may result in impressive GMV numbers but very poor unit economics. The fact of the matter is existing distribution networks are already quite efficient in the distribution of commodities.

The focus of technology-driven entrants must be making material, orders-of-magnitude improvements to the supply chain, not minor incremental ones. Minor improvements will not yield the value required to shift behaviour from traditional informal trading to e-commerce. What can you offer the trader they cannot get elsewhere? Are they willing to pay for it?

E-commerce is a long term play that will only succeed when its foundations are rooted in basic fundamentals related to unit economics and proper market segmentation.

Lack of Infrastructure Means Diversify Your Revenues

As the story goes, interest rates spiked starting in 2022, and along with global conflicts, made the macro environment less attractive. Cheap capital chasing the next emerging market miracle became less available.

Sustaining the growth trajectories for these companies predicated on follow-on rounds of capital became increasingly difficult. As each business attempted to solve for unit economics, they struggled to compete against long-standing established local market players.

It is worth considering that e-commerce in developed markets scaled on the back of four foundational infrastructures:

- Developed a payment system that managed risk between unknown buyers and sellers (credit cards)

- Reliable and cost-effective third-party logistics (National Postal Service / UPS / Fedex / DHL)

- Functioning street address system (locations can be identified by numbers and street names)

- Ubiquitously available ordering devices (computers)

In Africa with exception of mobile phones (computers), you can say none of this infrastructure is fully available so any e-commerce company must build it as part of its effort to address the market.

Building this infrastructure takes time via trial an error, any effort to shortcut the process will be costly, local informal players will take advantage.

Having said that, all of these missing infrastructures present opportunities for revenue outside of the core e-commerce space. Payments, logistics and connectivity all represent service opportunities for any company that can tackle the challenge.

I firmly believe an ecosystem approach is required for B2B and/or B2C e-commerce to succeed in Africa because of the poor fundamentals identified above.

While partnerships and cooperation with other players can work, that also depends on how advanced the country is and what level of service providers are capable of offering.

So, for example, if a customer places an order expecting it to arrive the next day, will a third-party provider be competent enough to meet the service requirement 90% of the time?

In some places, the answer is yes, and in other places, it is no. This again returns back to the one-size-does-not-fit-all market reality where certain pieces may exist in some markets, but are missing in others.

In other words, ecommerce players must find ways to use lack of infrastructure as an opportunity to generate revenue as both a trading platform as well as a service provider to other industries or verticals.

This can help manage your risk around cash flows and growth cycles, while also building infrastructure in a way that complements the trading business.

Relax Your Assumptions

Anyone looking to invest in e-commerce platforms in the region must relax certain assumptions around what growth looks like for these businesses. How do they address the lack of fundamentals in the market?

What aspect of those fundamentals are they able to monetize? How do they diversify their risk around trading cycles? What material improvement did they make over informal players, and what empirical evidence can they point to to demonstrate a willingness to pay on the part of actual customers?

The opportunity for B2B and B2C e-commerce in Africa is unquestionable. Many of these markets can dramatically benefit from improved transparency and greater efficiency around the movement of goods and services. There are a number of emerging success stories in this space.

You can point to Omnibiz in Nigeria, Cortana in Egypt and Sarafu in Tanzania (for which I am a co-founder) as examples of B2B e-commerce players who operationalized some of the lessons above and are succeeding in their respective markets. There is tremendous potential to unlock value around intermediating the commercial relationships of everyday trading activities.

Anyone courageous enough to do so must take a sober look at the reality of the market and return back to first principles thinking. If you are a VC looking to venture back into this space, spend some time talking to customers in these markets. They will tell you who is creating value for them and who is not.

For more Technology insights, visit my website, firasahmad.substack.com.