First, if you happen to be Mohammed Dewji or maybe among the billionaires, my apologies; the title does not apply to you. If not, welcome my fellow Tanzanians. It is once again that time of the year when we all ¨ooh¨ and ¨aah¨ at the Forbes annual billionaires list, wondering how these people became so rich and how we can emulate their successes or die trying.

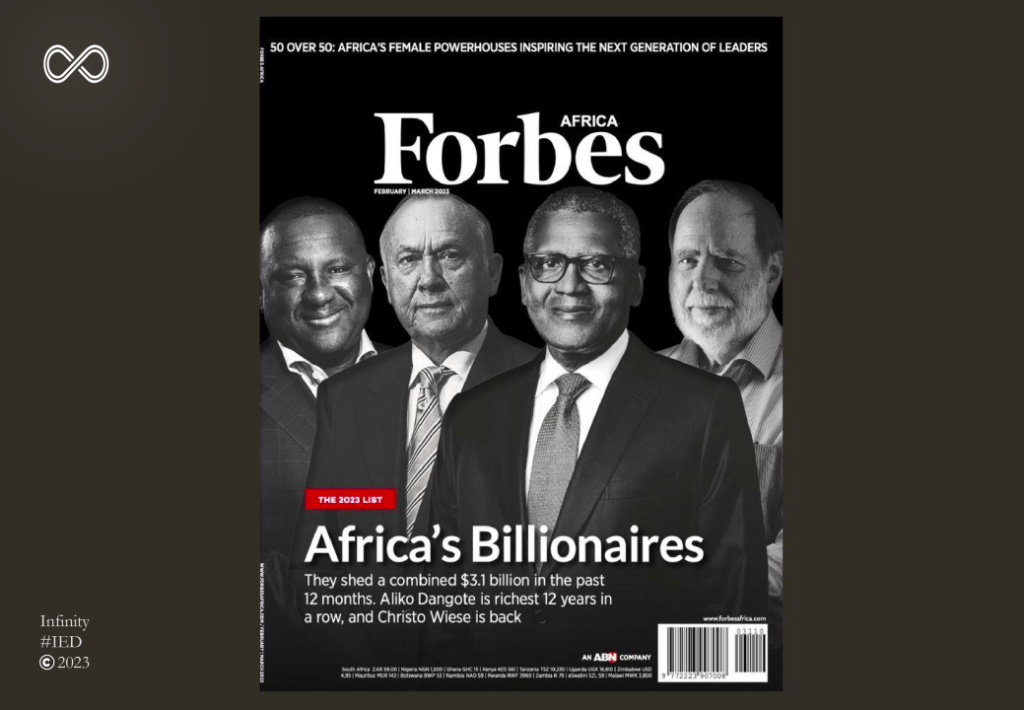

This year, I noticed something about the list that got me in a precarious mood, pushing me to put pen to paper. According to Forbes, of the 2781 billionaires in the world today, only 20 are Africans. In other words, Africans make up 18% of the world’s population but only 0.7% of the world’s billionaires.

To help that sink in a little better, here is another fun fact: there are almost as many African billionaires as crypto and bitcoin billionaires. If you know anything about cryptocurrency, you will understand my grievance. Many in financial circles consider The crypto movement a scam and a joke. This similarity in the numbers made me ask myself aloud, ¨Are Africans also a joke to the rest of the world?¨

I was amused when I heard a faint but cheeky voice retort, ¨It depends. Are clowns funny?¨

Nevertheless, the list contains valuable insights that we can use as a nation to understand what makes a billionaire and why we do not have what it takes yet.

Access to Global Financial Markets

The first clue comes from the methodology itself. Forbes determines individual net worth primarily from financial securities such as equity and stock prices. This is where most of the rich get their wealth.

Also, read Africa’s Debt Crisis Report: IMF Releases List of Top Ten African Countries with the Highest Debts.

Secondly, the industry with the largest concentration of billionaires is the Finance & Investment industry. This means people working in private equity, hedge funds, venture capital, investment banking, fintech, etc. Think Warren Buffett.

From those two points alone, one may assume that the road to riches passes through international capital markets. And they would be right to do so. 66% of the world’s billionaires became $2 trillion richer in 2023, mainly because the global stock markets skyrocketed. The S&P 500 gained more than 24%, the Nasdaq was almost 50 % higher, and even our questionable comrades, the ¨bitcoin bros¨, rose 152% in value.

Are these markets only for the elite? Absolutely not. The working and middle class in most countries have access to them. Sovereign wealth and pension funds invest in international stock markets all the time. Many countries have structured retirement plans that assist individuals in investing in financial securities. For example, the 401(k) plan offers US citizens different investment options, including foreign index and mutual funds, all managed by respectable financial advisory firms.

Unfortunately, this is not the case for Tanzanians. Knowledge of the myriad investment strategies on offer globally is not widely available, the government discourages and restricts trading in foreign stock markets, and sadly, our pension managers’ sole purpose is to ¨collect contributions and pay terminal benefits¨ rather than invest participants’ pensions for long-term growth.

I would much rather see my pension channelled into artificial intelligence, space travel, and robots instead of political campaigns and elections.

Industrialisation

Another interesting insight from the Forbes list is that the Manufacturing industry is not only the industry with the second-largest concentration of billionaires but also one that creates the highest number of new billionaires.

This shows plenty of opportunities and money to be made from those good old factories. Furthermore, other billionaire-concentrated industries, such as Technology and Fashion & Retail, rely on this industry in their supply chain. Manufacturing is basically the engine behind the world’s money-making machine.

This is also evident when you look at the countries where the Forbes billionaires are from. The number of billionaires from North America, Europe & Australia is comparable to those from newly industrialised nations like China, India, Brazil, Indonesia, Thailand, Philippines, and Malaysia.

To make the best of the present and plan well for the future, one must never ignore lessons from the past. History has repeatedly proven that, for a nation to prosper, unless it has massive oil deposits or is a strategically located tiny island, it must industrialise first and become a service-based economy second. Western developed countries took this route, and many developing countries in East Asia have enjoyed rapid growth by following this model.

Yet, the rate of premature deindustrialization in many African countries, including Tanzania, is alarming. We do not have the highly skilled, well-educated, and innovative labour force to drive a service-based economy. Until we do, we should not let naysayers shift our focus away from industrialisation.

Also, read The Dar es Salaam Stock Exchange: A Catalyst for Tanzania’s Financial Transformation.

We have all the natural resources and labour supply we need. With the right domestic industrial policies and investments in infrastructure and technological imports, we can sprint on this evidence-based path toward making the country and its citizens richer. Leapfrogging is risky and should be left only to smaller countries with limited resources and far less at stake.

Generational Wealth

Over one-third of the billionaires on this year’s list have inherited their wealth. This number is significant because it reflects what is happening in society today. We are now in a historic period where Baby boomers (born 1946-1964) are shifting their wealth to their Gen X, Millennial, and Gen Z children.

Although, according to Forbes, none of us in this country stand to inherit billions of dollars, the wealth shift is happening regardless and is an opportunity to reflect on how we view generational wealth as a nation.

Not to generalise, but Tanzanian boomers commonly carry a well-meaning sentiment that children should learn to be independent. Unfortunately, this often translates into ¨I started from nothing, neither. I grew my own business from scratch, and so should you. I built my house without any help from my parents, and you should too.¨

Many forget that wealth is a snowball that only grows bigger as it rolls down the hill, a relay race where each generation starts where the previous one stops. Wealth acquired in one´s lifetime is meaningless if one does not get more wealth after death.

Admittedly, there is also an infuriating complacency amongst many middle-class Tanzanians from younger generations. It appears that we are content with having the same or, at many times, less success than our parents. It is common to see university graduates only aiming for that loan-bought car and house, rarely daring to dream bigger.

We all desperately need a mindset shift. Parents need to talk to their children about money early on and remove the taboo. Estate planning should not start and end with a will written in later years of life. It should begin before your first child is born. Both current and future parents intending to pass on their wealth need to create forward-looking plans that include paying off debt, investing, saving, and signing up for life insurance.

I was tempted to download the billionaires list into an Excel sheet for a deeper analysis, but I am currently on holiday. I reckon billionaires do not crunch numbers while vacationing on their yachts, planes, and vineyards, so I will also stop here. Fake it till you make it, right?

As I put my pen down, my mood slightly improved. I think I managed to convince myself that we can make the necessary changes as a country to include more than one of us in the billionaires list in the future. And if not, well, there is always crypto.