In the second phase of our series on rethinking corporate taxation, we present transformative strategies grounded in global best practices and informed by insights from policymakers, financial analysts, and business leaders, aiming to attract investment, enhance competitiveness, and drive sustainable growth in Tanzania.

Sector-Specific Tax Incentives

Tanzania’s proposed corporate tax reforms prioritize sector-specific incentives, serving as a foundation to drive innovation and promote sustainable development, as highlighted by Mr. Charles from the Export Processing Zones Authority (EPZA). He further narrated that by prioritizing industries such as technology and renewable energy, Tanzania has the opportunity to diversify its economy and attract substantial investments. Singapore’s experience with R&D tax credits demonstrates the immense potential of such measures. Over a decade, Singapore doubled its technological contributions to GDP, with private R&D spending increasing by 50 per cent, from approximately USD 15 billion to USD 22.5 billion. If Tanzania invests 1 per cent of its GDP (USD 1 billion) into similar R&D tax incentives, it could stimulate a 50 per cent growth in private sector R&D spending, leading to a USD 500 million annual increase in technological outputs.

Likewise, Research further showed that Kenya’s renewable energy policies underline the effectiveness of strategic tax incentives. Tax holidays and VAT exemptions helped Kenya achieve over 70 per cent renewable energy production. Tanzania, with renewable energy at 37 per cent, could realistically aim for 50 per cent within the next decade by adopting similar policies. Assuming a growth rate of 1.3 per cent annually, investments in green technology could attract USD 3 billion (based on USD 200 per kW installation costs for renewable projects), reducing energy costs by 20 per cent and creating thousands of jobs in green sectors.

Simplifying and Harmonizing Tax Codes

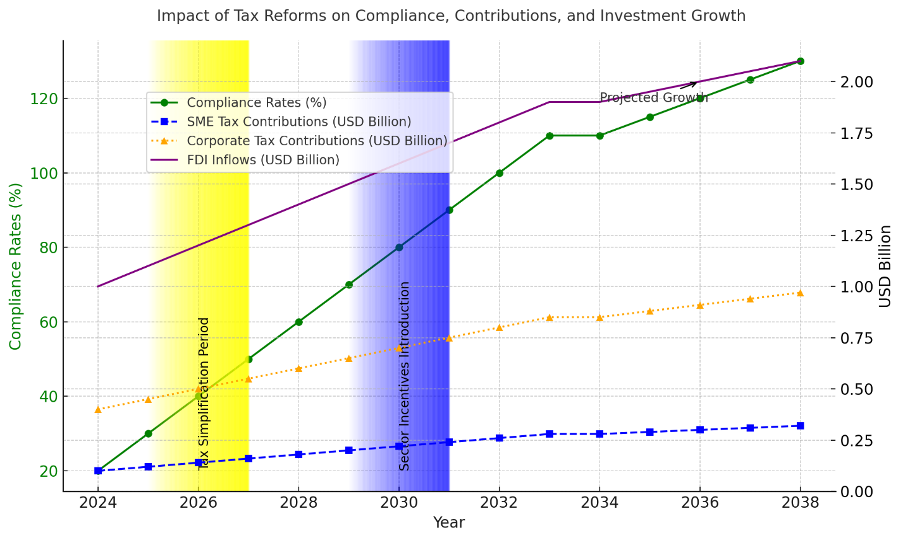

Simplifying and harmonizing Tanzania’s complex tax codes is a key reform aimed at enhancing the investment climate, as emphasized by Sinda Mwita, a lecturer at the Institute of Tax Management. She, along with other stakeholders, underscored that streamlined tax laws reduce administrative burdens, lower compliance costs, and offer businesses clear and consistent guidelines—promoting transparency and building trust. After stakeholders emphasized the potential benefits of simplified and competitive tax systems, researchers from the Daily News set out to validate these claims and found compelling evidence from Mauritius. They discovered that after implementing a flat corporate tax rate of 15%, Mauritius experienced a 15% annual increase in foreign direct investment (FDI), which grew from USD 250 million in 2010 to USD 540 million in 2021. Additionally, GDP per capita rose from USD 7,500 to USD 9,000 during the same period, showcasing the positive economic impact of such reforms. If Tanzania simplifies its tax regime and attracts a similar 15 per cent annual FDI growth, its FDI could grow from USD 1 billion to USD 1.2 billion annually within five years, adding USD 5 billion to GDP over a decade.

Supporting Startups and SMEs

Mr. Innocent Mathias, Head of Policy and Research at the Tanzania Startup Association, emphasized the critical role startups and small and medium enterprises (SMEs) play in Tanzania’s economic growth, contributing 35% of GDP and employing over 50% of the workforce. He highlighted that targeted tax reductions and simplified regulations could significantly lower entry barriers and encourage entrepreneurship. Supporting this, research from India revealed that tax exemptions for startups during their first five years resulted in an impressive 80% survival rate for these businesses, compared to the global average of 50%, demonstrating the tangible benefits of such policies. These policies also contributed to USD 15 billion in additional startup funding between 2015 and 2020. If Tanzania reduces capital gains tax to 5 per cent and exempts startups from the Alternative Minimum Tax, it could encourage the establishment of 1,000 new startups annually, generating USD 2 billion in economic activity (assuming USD 2 million per startup in annual contributions).

Modernizing Tax Administration

A senior executive from one of the globally renowned Big Four audit firms, which also operates in Tanzania, emphasized the importance of modernizing Tanzania’s tax administration through digitalization. This transformation is seen as critical for enhancing efficiency and compliance in a system where 40% of businesses currently face challenges with timely tax filings. Rwanda’s e-tax system is estimated to have significantly improved tax administration, reducing compliance time from 200 to 88 hours annually. This has led to a 25% increase in compliance rates and an 18% boost in tax revenues, adding an estimated USD 200 million annually. Based on a tax-to-GDP ratio of 17.7% and a GDP of USD 10.3 billion, total tax revenue is estimated at USD 1.82 billion. An 18% increase from these efficiencies equals USD 327 million, with USD 200 million serving as a conservative projection of the system’s impact. Kenya’s iTax system achieved a 30 per cent increase in compliance, generating an additional USD 500 million in tax revenue between 2016 and 2020. If Tanzania integrates AI and data analytics, it could see a 15 per cent revenue increase, adding USD 300 million annually to its treasury while reducing filing errors by 50 per cent.

Graduated Corporate Tax Rates

Introducing graduated corporate tax rates can promote fairness by reducing the tax burden on SMEs, which constitute 90 per cent of all businesses in Tanzania and contribute 35 per cent of GDP, while ensuring that larger corporations contribute proportionately. Germany’s graduated tax system increased overall tax revenue by 5 per cent annually, equivalent to USD 15 billion in additional revenue. For Tanzania, this could mean a USD 100 million annual increase from SMEs (assuming a 10 per cent growth in SME tax contributions) and USD 400 million from larger corporations, creating a balanced framework that drives sustainable growth.

Strategic Sector Incentives

Strategic tax incentives targeting key sectors such as agriculture, manufacturing, and technology are vital for economic diversification. Ireland attracted €70 billion (USD 77 billion) in foreign investment over a decade through targeted incentives, increasing FDI inflows by 12 per cent annually. This investment created 140,000 jobs and contributed to a 15 per cent GDP rise. If Tanzania adopts similar policies and increases sector-specific FDI by 10 per cent annually (from USD 1 billion to USD 1.6 billion in five years), it could add USD 4 billion to GDP and create over 100,000 jobs, particularly in high-value manufacturing and technology sectors.

Efficient Dispute Resolution Mechanisms

Efficient tax dispute resolution mechanisms are essential for enhancing investor confidence. South Africa’s tax tribunal reduced dispute resolution times by 40 per cent, recovering USD 1 billion annually in disputed revenues. Tanzania’s FDI inflows, currently at USD 1 billion, could increase by 20 per cent (USD 200 million annually) with reduced business uncertainties stemming from fair and timely dispute resolutions. This improvement assumes a 30 per cent reduction in tax-related business interruptions, fostering operational stability and boosting international investor trust.

Regular Policy Reviews

Regular reviews of tax policies are crucial for maintaining relevance and adaptability in a rapidly changing economic landscape. Singapore’s practice of conducting annual tax policy updates has sustained steady GDP growth of 3–5 per cent over the past decade, contributing to its rise as a global financial hub. Annual updates allow policies to adapt to evolving global markets, ensuring continued competitiveness. If Tanzania adopts a similar framework, it could achieve a 2–3 per cent annual increase in GDP. This assumption is based on the premise that regular policy adjustments would reduce regulatory uncertainty and align taxation structures with emerging economic opportunities, translating to approximately USD 2 billion in additional annual economic output (calculated as 2 per cent of Tanzania’s USD 100 billion GDP).

Advancing Sustainability with Green Tax Incentives

Sustainability-focused tax reforms can position Tanzania as a leader in renewable energy and green technology. Denmark’s green tax incentives increased renewable energy production from 22 per cent to 30 per cent of total energy output within five years, reducing carbon emissions by 15 per cent annually. Tanzania’s renewable energy capacity currently stands at 37 per cent. A 13 per cent increase (to reach 50 per cent within a decade) would require annual growth of approximately 1.3 per cent, a realistic target given Tanzania’s vast untapped renewable resources. If implemented, this could attract USD 3 billion in investments (based on global renewable energy investment averages of USD 230 per kW capacity for new installations) and create over 50,000 jobs (assuming 16 jobs per megawatt as seen in similar projects globally).

Enhancing Tax Education

A certified financial educator from the Bank of Tanzania (BOT) highlighted that enhancing tax education could play a crucial role in improving compliance, particularly among SMEs. Supporting this, research from South Africa revealed that tax education programs led to a 10% increase in compliance rates among newly registered SMEs within two years, contributing an estimated USD 200 million in additional annual tax revenues. Tanzania has an estimated 3 million informal businesses, supported by studies like a 2019 ILO survey showing over 1 million in Dar es Salaam alone. Formalizing 25% of these businesses (750,000) over five years, with each contributing USD 267 annually—based on South Africa’s average SME tax contributions—could add USD 200 million in annual tax revenue. This assumes formalization improves compliance and reduces errors and disputes.

Strengthening Anti-Avoidance Measures

Robust anti-avoidance legislation is essential to prevent profit shifting and ensure that multinational corporations pay their fair share of taxes. Australia’s anti-avoidance laws have recovered over AUD 10 billion in tax liabilities since 2016, improving compliance among multinational corporations by 30 per cent. Tanzania collects approximately USD 2 billion in corporate taxes annually. A 15 per cent increase from anti-avoidance measures (based on results seen in comparable jurisdictions like Australia) would yield an additional USD 300 million annually. This estimate assumes that targeted audits, legislative reforms, and international cooperation effectively address tax evasion.

Incentivizing Digital Economy Growth

Tanzania can encourage growth in its digital economy by introducing tax breaks and incentives for tech startups and e-commerce platforms. Nigeria’s digital economy grew by 15 per cent annually after introducing tax holidays for IT firms and reducing tariffs on software imports, contributing an additional USD 10 billion to its GDP over five years. Assuming a similar 15 per cent annual growth in Tanzania’s digital economy, which is currently valued at an estimated USD 1 billion, this sector could contribute an additional USD 1 billion to GDP annually within five years. The creation of 20,000 high-skilled jobs is extrapolated from Nigeria’s ratio of digital sector growth to job creation.

Reducing Compliance Complexity for SMEs

Simplified tax regimes specifically designed for SMEs can reduce compliance burdens and increase participation in the formal economy. Zambia introduced a turnover-based tax for SMEs, resulting in a 20 per cent rise in tax compliance and generating an additional USD 50 million in revenue annually. Tanzania has approximately 3 million informal businesses, with 20 per cent (600,000) likely to formalize under similar reforms. Assuming an average annual tax payment of USD 500 per SME, Tanzania could generate USD 300 million in new revenue while significantly reducing administrative barriers.

Encouraging FDI Through Tax Treaties

Mr. John Wanyancha, a director at Serengeti Breweries Limited, emphasized the importance of tax treaties with major economies in providing clarity and reducing double taxation for international investors. Supporting his statement, stakeholder analysis highlighted Ethiopia’s tax agreements with China and India, which led to a 30% increase in foreign direct investment (FDI) inflows, contributing an additional USD 2 billion to the economy over five years. Tanzania receives approximately USD 1.3 billion annually in FDI, according to the World Investment Report 2023. Tax treaties with major economies, such as the EU and US, could boost FDI by 30%, as seen in Ethiopia’s agreements with China and India. This could add USD 390 million annually, increasing inflows to USD 1.69 billion, by enhancing investor confidence and reducing tax barriers in key sectors like infrastructure and manufacturing.

Promoting PPPs Through Tax Incentives

Tax incentives for public-private partnerships in infrastructure development can accelerate economic growth. India’s PPP model, supported by tax exemptions on long-term infrastructure projects, led to a 12 per cent annual increase in public infrastructure investments, equivalent to USD 50 billion over a decade. Tanzania currently invests approximately USD 5 billion annually in infrastructure. A similar 12 per cent increase would translate to USD 600 million annually, enhancing roads, energy, and port facilities. This assumes that tax incentives effectively attract private investors and increase project financing efficiency.

Epilogue

As senior analysts at the Daily News business desk, we view corporate tax reform as a pivotal tool for unlocking Tanzania’s economic potential by advancing policies that balance equity, simplicity, and strategic incentives, while empowering local enterprises, fostering innovation, and driving sustainable growth to create a collaborative environment where businesses thrive and contribute to national development, ultimately positioning Tanzania as a rising economic leader in Africa.

Read More articles on Taxes by Kelvin Msangi