This isn’t just a story about money; it’s a tale of transformation.

In the thrilling landscape of global finance, the financial revolution that is unfolding in Tanzania, an East African nation, is crafting a compelling narrative of resilience, innovation, and progress. This chronicle has all the intriguing elements – pioneering technology, transformative regulations, and captivating success stories that make the traditional hubs of finance seem a tad conventional.

The Magic of Mobile Money

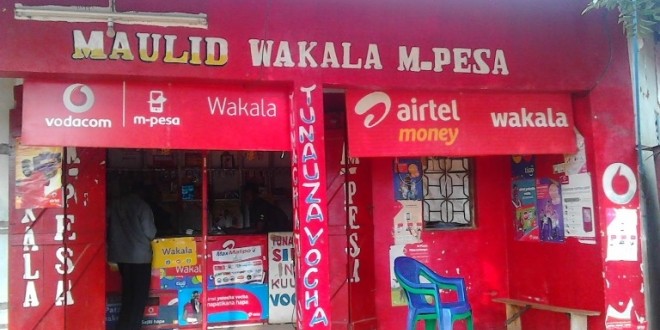

Our tale begins in 2008, in a country where sending money from one town to another was as arduous as a Herculean labor. There were buses loaded with cash, perilous journeys across hundreds of miles, and the constant fear of loss or theft. Then, in a dramatic turn of events, along came a knight in shining armor named M-Pesa. Suddenly, sending money was as easy as sending a text message, and life in Tanzania began to change.

To understand the impact of M-Pesa, let’s consider the story of Salma Kilomoni, Known as Mama Asha, with 47 years old, a local fruit vendor i met at Kinondoni Mwanamboka, from the bustling streets of Dar es Salaam.

As I strolled along, I encountered this self-reliant widow, a Mother who sustains her family through the fruitful trade of fruits. One thought consumed me: to unravel the secrets of her journey, how she navigated the realms of commerce since embarking on this venture at the tender age of 24, since back she started this business in the early 2000s.

Before the mobile money revolution, she’d traverse daunting distances to pay her suppliers, always bearing the risk of carrying large amounts of cash. Now, with M-Pesa, she sends payments with a few taps on her phone, saving precious time and enhancing her safety. This dramatic transformation isn’t unique to Mama Asha – it’s a shared experience for millions of Tanzanians who have seen their lives improved through this innovative platform. See? Stunning, right? I never even imagined recognizing that it took her a considerable time to establish herself in this business often deemed invaluable! All is the power of God!

Regulatory Mavericks and the Road Less Traveled

While technology was setting the stage for this dramatic transformation, an equally intriguing subplot was unfolding in the corridors of power. Tanzania’s government and central bank were working behind the scenes, implementing rules and regulations that have been just as revolutionary. A pivotal moment in this narrative came in 2015 with the introduction of the National Payment Systems Act.

This Act wasn’t just a piece of legislation; it was a transformative tool that gave mobile money platforms a clear framework within which to operate. It assured their legality, encouraged efficiency, and laid the foundation for the unprecedented financial inclusion that Tanzania experiences today. This proactive regulatory approach has not only boosted public confidence in these platforms but has also catalyzed the growth of the sector, illustrating the power of progressive policy-making.

The Fintech Phenomena: David Takes on Goliath

In the shadow of mobile money giants, a fresh breed of financial innovators has emerged. Fintech start-ups, brimming with ambition and driven by the transformative power of technology, are creating new platforms and services that challenge the status quo. These are Tanzania’s own David vs. Goliath stories, featuring ambitious start-ups daring to compete with the established financial institutions.

One such tale is of Nala, a homegrown fintech start-up that has created a unique app simplifying and speeding up mobile money transactions, even without internet access. Despite the challenges of penetrating a market dominated by established giants, Nala’s story is one of success and innovation, showing that even in the world of finance, the underdog can rise to the top.

A Winding Path Ahead

Like any thrilling saga, the tale of Financial Innovation in Tanzania is not all sunshine and rainbows. The path to financial inclusion is littered with obstacles. Limited internet penetration remains a significant challenge, excluding many from accessing digital financial services. Meanwhile, cybersecurity lurks as an ever-present villain, threatening to disrupt the narrative with breaches and data thefts.

However, every captivating tale requires conflict, and these challenges provide just that. They represent an opportunity for the sector to grow and evolve further. By investing in digital infrastructure, improving cybersecurity, and expanding financial education, these barriers can be converted into stepping stones that propel Tanzania further along the path of financial inclusion and innovation.

A Tale Unfinished

The story of finance in Tanzania is far from complete. This ongoing saga is a vibrant tapestry of heroes, trials, triumphs, and transformations. It’s a tale of how innovative thinking can redefine an economy, lift millions out of financial exclusion, and create a more inclusive and equitable society.

As digital finance continues to evolve, this saga promises more plot twists, more milestones, and a brighter future for Tanzania’s economy. This isn’t just a financial thriller; it’s an epic tale of change, resilience, and progress. And it’s a tale you’ll want to follow, for its conclusion promises to be as captivating as its unfolding.

Read more of Technology articles here.