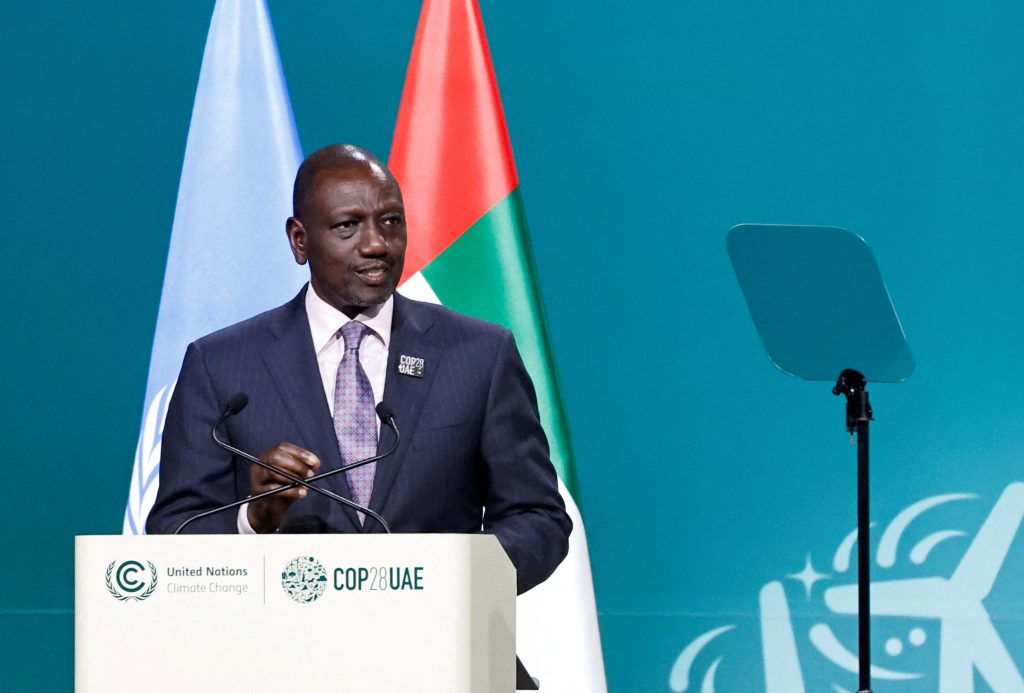

Kenya is now considering an exit from its Government (G2G) deal with Saudi Arabia, acknowledging that it has failed to alleviate pressure on the dollar and has led to distortions in the forex market. Launched in April 2023 by President William Ruto, the G2G deal aimed to stabilize the Kenyan shilling against the dollar.

The agreement, involving three national oil exporters from the Gulf, entails a six-month credit arrangement for oil imports, supported by letters of credit issued by participating commercial banks.

“The government intends to exit the oil import arrangement, as we are cognizant of the distortions it has created in the FX market, the accompanying increase in rollover risk of the private sector financing facilities supporting it and remain committed to private market solutions in the energy market,” the Treasury is quoted in an IMF report published Wednesday.

The government admits the deal was short-term to help ease foreign exchange pressures.

As an interim measure to help ease FX pressures, Kenya introduced a new oil import arrangement in April 2023. It replaced the previous open tendering system, under which oil import dues were payable upon five days of delivery, often creating undue FX market pressures.

In the first 6 months, the average monthly import volumes fell short of the agreed-upon minimums. This was due to lower demand from our domestic market and the regional re-export markets.

At first, the Kenya Kwanza administration did not admit to the failure of the government-to-government oil arrangement with Saudi Arabia.

In a recent statement, National Treasury Cabinet Secretary Njuguna Ndung’u clarified information attributed to the International Monetary FuNdung’u), asserting that the media misrepresented the facts. He emphasized that their communication to the IMF addressed the expected rollover risk linked to private sector financing facilities supporting the arrangement.

The Treasury Secretary aims to correct any misunderstandings regarding the nature and success of the financial arrangement.

By drawing parallels with experiences from Nigeria and South Africa and delving into Tanzania’s own G2G encounters, this article explores the intricate web of Tanzania’s these nations face and the subsequent impacts on currency stability.

Examples from Across Africa

Nigeria’s venture into a G2G deal to secure oil stability provides Nigeria’s study. Despite optimistic expectations of currency stabilization, the Nigerian naira experienced unexpected fluctuations due to the nuanced dynamics of global markets and unanticipated challenges during the deal’s implementation.

South Africa’s pursuit of a G2G agreement for resources serves as Africa. The promise of strengthening the South African rand remained unmet, highlighting the importance of a comprehensive understanding of market dynamics and potential impediments before entering such agreements.

The Tanzanian Experience

Tanzania’s foray into G2G deals contributes a unique perspective to the nation. The nation faced scrutiny over transparency concerns and accusations of favouritism in distributor selection while engaging in such agreements. A specific case involved allegations that a “handpicked distributor” sold oil at significantly higher prices than suppliers, raising questions about fairness and competitiveness in the selection process.

Furthermore, Tanzania’s experience emphasizes the crucial role of transparency in G2G Tanzania. The lack thereof can lead to eroded market confidence, as illustrated by instances where accusations of opaque practices influenced public perception and hindered foreign investment.

Read Related Tanzania’s Economic Dilemma: The Falling Dollar Conversion Rate.

Financial Impact on Kenya

Examining the financial impact on Kenya reveals a complex scenario. Acknowledged low demand and subsequent dips in import volumes indicate potential stress on foreign exchange reserves, impacting the exchange rates of the Kenyan shilling and overall economic stability.

Market distortions, failure to ease forex pressure, and overoptimistic currency forecasts highlight the need for a nuanced understanding of market dynamics. Allegations concerning distributor selection and inflated oil prices add an extra layer of complexity, indicating potential consequences on consumer costs and contributing to inflationary pressures.

Implications for TanzTanzania’snia’s experiences further underscore the importance of transparent processes in G2G deals. The accusations of favouritism in distributor selection and allegations of inflated oil prices have tangible implications. If proven true, these practices can impact consumers, increase fuel-related product costs, and contribute to inflationary pressures.

Analyzing the Financial Impact

Currency Instability: Unsuccessful G2G deals can increase volatility in foreign exchange markets, impacting trade balances and investor confidence.

Foreign Exchange Reserves: Low demand and import volumes may strain foreign exchange reserves, affectingcountry’stry’s ability to meet international payment obligations and potentially leading to a depreciation of the national currency.

Market Confidence: Allegations of transparency issues can erode market confidence, discouraging foreign investment and hindering economic growth.

Consumer Impact: Inflated prices due to distributor practices can impact consumers, leading to increased costs for fuel and related products, affecting household budgets and contributing to inflationary pressures.

Analyzing experiences from Kenya, Nigeria, South Africa, and Tanzania reveals common themes and unique challenges in G2G deals. Transparency, fair distributor selection processes, and a realistic understanding of market dynamics are paramount for the success of such agreements. As these nations navigate their economic landscapes, lessons from successes and setbacks will shape future policies, ensuring a more robust and sustainable economic growth trajectory.