Inflation, defined as the general increase in prices and fall in the purchasing value of money, is an economic phenomenon affecting countries globally. Like many developing nations, inflation control is a critical aspect of economic management in Tanzania. Digging Deep into Tanzania’s battle against inflation, this article explores the various tactics employed to curb rising prices and their financial implications. Through a thorough examination of data and analysis, we assess the effectiveness of these strategies and their overall impact on Tanzania’s economic landscape.

Tanzania’s economy has shown considerable resilience over the years, with an average GDP growth rate of 6% annually from 2010 to 2020. Despite this impressive economic performance, controlling inflation has remained a priority for the Tanzanian government and the Bank of Tanzania (BoT), the nation’s central bank.

Tanzania Inflation Rate in 2023

According to statistical data provided by Tanzania Invest, in the first four three of 2023, Tanzania’s annual headline inflation rate was 4.9% in January, 4.8% in February, and 4.7% in March. Inflation in Mainland Tanzania eased for the third month in a row to 4.3% in April 2023, remaining below the target of 5.4% for 2022-2023. In Zanzibar, inflation rose to 7.5% in April 2023 from 7.1% in March 2023, remaining above the medium-term target of 5%, largely due to increased food prices.

Tanzania Inflation Rate in 2022

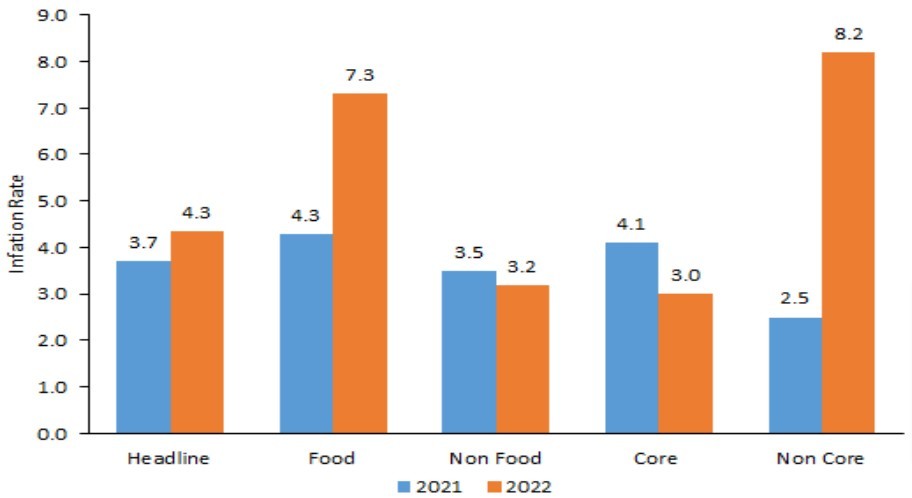

In 2022 (January to December) the average annual headline inflation in Tanzania was 4.3%. In 2021 it was 3.7%, and 3.3% in 2020. However, the trend is upward, with annual inflation reaching a five-years in October 2022 at a rate of 4.9% and slightly going down only in December 2022 at 4.8%. Still, it remains within the target range of 3.0%-5.0% over the medium term included in the Tanzania Five-Year Development Plan (FYDP III). It also falls below the EAC inflation target of 8% and the SADC region which ranges between 3% and 7%. In 2022, food inflation reached 7.3% versus 4.2% in 2021, while non-food inflation slightly fell to 3.2% from 3.5%.

Tanzania Inflation Rates in 2021

In 2021, the average annual headline inflation in Tanzania was 3.7% versus 3.3% in 2020. The headline inflation declined dramatically in the last decade, from an annual average of 16% in 2012 to 3.7% in 2021. Generally, the fall has been on account of improved food supply in the domestic market and neighboring countries, stability of global oil prices, and prudent fiscal and monetary policies.

The increase in inflation from 2020 to 2021 is mainly attributed to an increase in core inflation to 4.1% from an average of 2.3% recorded in 2020. However, the annual average inflation rate for food and non-alcoholic beverages decreased to 4.2 % in 2021 from 4.8% recorded in 2020. The average yearly inflation rate for all items without food and non-alcoholic beverages in 2021 has also decreased to 3.5% from 3.7% in 2020. 2021 the lowest inflation rate was 3.2%, noted in March, and the highest rate was 4.2% in December 2021.

Latest update: 28th May 2023

Sources: Bank of Tanzania (BOT, Tanzania National Bureau of Statistics (NBS), Tanzania Ministry of Finance, World Bank (WB).

BoT’s Strategies to fight against Inflation

One of the key strategies employed by the BoT is Monetary Policy, which involves adjusting interest rates to influence borrowing and spending behavior. The BoT aims to reduce money supply by increasing interest rates and curbing inflationary pressures. Conversely, during periods of economic slowdown, the BoT may lower interest rates to stimulate borrowing and boost economic activity.

In addition to monetary policy, the BoT employs other tools such as open market operations and reserve requirements. Open market operations involve buying or selling government securities to regulate liquidity in the financial system. By adjusting the money supply in circulation, the BoT can influence inflationary trends. On the other hand, reserve requirements mandate that commercial banks maintain a certain percentage of their deposits as reserves. This helps manage liquidity in the banking system and control excessive lending, which can contribute to inflation.

The BoT’s strategies to fight against inflation have shown positive results in Tanzania’s economy. Inflation rates have been kept within manageable levels, ensuring price stability and safeguarding the purchasing power of consumers. These efforts have fostered a conducive environment for economic growth and investment, as businesses can make informed decisions without the uncertainties associated with high inflation.

A primary strategy that BoT employs in controlling inflation is interest rate adjustments. When inflation trends upward, BoT often increases the Discount Rate – the rate commercial banks borrow from the central bank. This makes borrowing more expensive, thus reducing the money supply in the economy, which controls price levels.

According to BoT data, Tanzania’s annual headline inflation rate was 3.3% in June 2023, within the medium-term target range of 3-5%. This reflects the central bank’s commitment to maintaining price stability, which, in turn, fosters a conducive environment for economic growth and wealth creation.

Fiscal policy, specifically efficient government spending and revenue collection is another strategy employed to manage inflation in Tanzania. The government can control the amount of money circulating in the economy by operating its budget deficits. The Tanzanian government has demonstrated efforts towards fiscal consolidation, targeting a fiscal deficit of 1.9% of GDP in 2023, compared to 2.1% in 2022, thereby reducing the money supply and controlling inflation.

Here are more of BoT’s strategies, collectively contributing to the BoT’s efforts to combat inflation and maintain price stability in Tanzania’s economy.

- Reserve Requirements: The BoT sets the minimum reserve requirements for commercial banks, determining the amount of funds they must hold as reserves. This helps control the money supply and curb inflation.

- Foreign Exchange Management: The BoT intervenes in the foreign exchange market to stabilize the value of the Tanzanian shilling, which can impact import prices and inflation.

- Macro-prudential Policies: The BoT implements measures to ensure the financial system’s stability and prevent excessive credit growth, which can fuel inflation.

- Fiscal Policy Coordination: The BoT works with the government to align fiscal policy decisions with monetary policy objectives, ensuring consistency and addressing inflationary pressures.

- Price Stability Communication: The BoT provides clear communication about its inflation targets, policy actions, and economic outlook to guide market expectations and influence inflation behavior.

- Data Monitoring and Analysis: The BoT closely monitors key economic indicators and conducts in-depth analysis to assess inflation trends and identify potential risks.

- Financial Sector Supervision: The BoT regulates and supervises financial institutions to maintain sound banking practices, ensuring stability and preventing systemic risks that could contribute to inflation.

- Economic Research and Forecasting: The BoT conducts economic research and forecasting to enhance its understanding of inflation dynamics and inform policy decisions.

Balancing the Impacts: Inflation Control’s Impact Consequences

Inflation control also affects various sectors of the Tanzanian economy. They have controlled inflation results in stable input and output prices in the agricultural industry, contributing approximately 26% to the country’s GDP and employing about 65% of the population. This stability encourages investment in the industry, leading to increased productivity and, consequently, economic growth.

Similarly, in the financial sector, controlled inflation results in lower and stable interest rates, stimulating borrowing for investment and boosting economic activities. Moreover, controlled inflation creates a favorable environment for foreign investment, thereby bringing in foreign exchange and fostering economic growth.

However, it is important to note that while these strategies have proven effective, they are not without challenges. External factors such as global commodity prices, especially for oil, pose inflationary pressures. Additionally, the effects of climate change on agriculture, a crucial sector in Tanzania, can cause food inflation.

Inflation control strategies are pivotal in shaping Tanzania’s economic landscape, contributing to stable economic growth. While monetary and fiscal policies remain central to managing inflation, the government must also focus on addressing structural issues such as boosting agricultural productivity and diversifying the economy. In doing so, Tanzania can strengthen its inflation control measures, fostering a stable and prosperous economic future.

Read more articles on Tanzania Economy