Yesterday, as I boarded our usual local “DalaDala”, an unexpected conversation unfolded with a woman whose appearance suggested a seasoned age of 40 to 45. To my surprise, she revealed being just 30. As we conversed, she disclosed her role as a liquor store owner in Sabasaba Mwanza, Tanzania, setting the stage for a narrative that unveiled the challenges small business owners face in the region.

Her narrative took an unexpected turn when she began recounting how power cuts detrimentally impacted her liquor store business and, more significantly, her struggles with loan repayment. The astonishing revelation that she paid 8,000 Tanzanian Shillings daily on a 300,000 Shilling loan over two months equated to an exorbitant 60% interest rate.

And when she misses a day without repaying, she faces a 3,000 fine. It was a staggering realization, and I couldn’t help but connect it to the visible toll it had taken on her appearance.

Intrigued, I inquired about the source of the loan, only to discover that it came from a credit institution at the Sabasaba market known for providing such loans. This revelation sparked a broader conversation about small businesses’ challenges in accessing formal financial services.

Informal Lenders: The business bloodhounds.

The bloodhounds, as the informal lenders were referred to, exploited a vulnerability in the formal financial service providers (FSPs) system. These FSPs often struggled to extend loans to small businesses due to the lack of collateral and financial history, including the absence of bank statements.

The reasons behind the reluctance of small businesses to open bank accounts were multifold: limited capital forcing reliance on trade credit, excessive charges, and the convenience of mobile money wallets.

Moreover, many small and medium enterprises (SMEs) operate traditionally, storing business records poorly and hindering FSPs’ ability to verify their legitimacy. Poor financial literacy also contributed to the problem, as businesses defaulted on loans, using the funds for personal needs rather than business growth. Creating a loop in which these bloodhounds operate.

Digital lenders: Microcredit but Macro challenges.

Fintech has emerged as a vital force, acknowledged for its potential to create more efficient and competitive financial markets while expanding access to finance, especially for traditionally underserved consumers. But through this innovation comes a new spring of bloodhounds in the name of digital lenders.

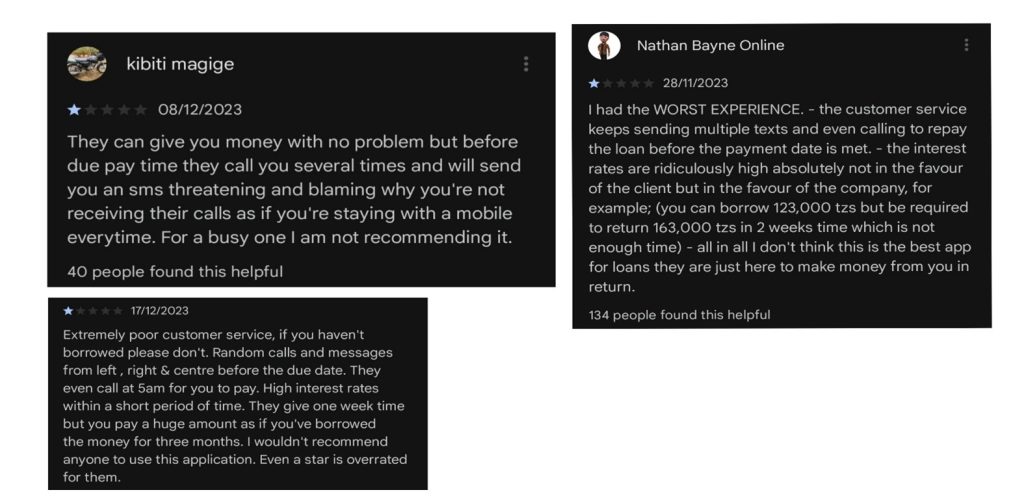

These digital lenders operate questionably by attracting businesses and individuals with promises of collateral-free loans, for example, up to 3,000,000 Tsh. However, users must accept poorly informed terms and conditions upon signing up, granting unnecessary access to contacts, messages, and cameras.

The loans offered fall short of the promised amount, accompanied by high-interest rates. Failure to repay results in threatening messages sent to contacts, invading privacy and potentially harming one’s reputation. Furthermore, users are coerced into taking additional, undesired loans, perpetuating a problematic cycle even after repayment.

RELATED: Online Loan Apps in Tanzania: Are Your Personal Details at Risk?

From my observations (you can agree with me), the biggest advertisers on the Tanzanian internet are microcredit providers. But my question of their regulation looms large. The rapid growth of mobile money and fintech in the region had created an environment where these microcredit providers seemingly operated without adequate oversight.

Drawing parallels to global experiences, I noted the cautionary tales of the peer-to-peer lending market in China in the 2010s, which, after rapid expansion, witnessed platform collapses, fraud, and operator misconduct. We are seeing the wave now in Tanzania and East Africa.

So, What I Think Should Be Done:

Addressing the challenges faced by small businesses in Sabasaba, Tanzania, and similar contexts requires a multifaceted approach that combines regulatory, educational, and technological interventions. Here are some suggestions for what should be done to foster a more supportive environment for small businesses:

Regulatory Oversight: Strengthen and enforce regulations: Authorities like the Bank of Tanzania must rigorously enforce regulations prohibiting unlicensed lenders. Regular audits and stringent penalties for non-compliance can act as deterrents and protect businesses from exploitative practices.

Financial Literacy Programs: Implement financial education initiatives: Conduct workshops and training programs to enhance the financial literacy of small business owners. Educating entrepreneurs about responsible borrowing, budgeting, and effective use of loans can empower them to make informed financial decisions.

I have seen an initiative by BoT to promote financial literacy; if well implemented and if it directly reaches the minority group that is widely affected, it may help to decrease the causalities they are currently facing.

Formal Financial Inclusion: Facilitate access to formal financial services: Work towards creating avenues for small businesses to access formal financial institutions. This may involve creating tailored financial products that consider the unique challenges faced by these businesses, such as lower capital and lack of collateral.

Community-Based Support: Establish community support networks. Encourage the formation of local business associations or cooperatives where entrepreneurs can share experiences and insights and support each other. This collaborative approach can strengthen the resilience of small businesses and create a sense of community.

Government Initiatives: Incentivize responsible lending: Introduce incentives for financial institutions that engage in responsible lending practices, such as offering lower interest rates or tax benefits. This can encourage a shift towards sustainable lending practices.

Data Management and Verification: Develop digital infrastructure: Invest in digital systems that facilitate the collection and verification of business data. This can streamline the process for formal financial institutions to assess the creditworthiness of small businesses, even those with traditional record-keeping practices.

Consumer Protection: Enhance consumer protection measures: Implement and strengthen mechanisms that protect borrowers from predatory lending. This could include setting caps on interest rates, ensuring transparent terms and conditions, and establishing avenues for dispute resolution.

Collaboration with Fintech Companies: Collaborate with Fintech companies: Engage with Fintech innovators to create solutions that cater specifically to the needs of small businesses. This collaboration can bring about technological advancements that make financial services more accessible and affordable—for example, partnering with B2B SaaS providers servicing the SMEs, such as Nemobase and more, to offer these loans directly to SMEs and access businesses’ credit and business history.

Empower Alternative Credit System: Explore alternative credit scoring methods. Develop and implement alternative credit scoring systems beyond traditional metrics. Utilize non-traditional data, such as payment histories with utility providers or suppliers, social media activity, and business transaction data, to assess the creditworthiness of small businesses. This can open up avenues for companies that lack conventional collateral or financial histories, providing them with fair access to credit.

Adopting a comprehensive strategy that combines regulatory measures, educational initiatives, and technological advancements can create an environment where small businesses in Sabasaba and similar communities can thrive, free from exploitative lending practices.

A Call to Action

The narrative of financial struggles small businesses face in Tanzania underscores the urgency for concerted efforts and strategic interventions. The challenges articulated by the liquor store owner not only shed light on the perils of informal lending practices but also reveal broader systemic issues that impede the growth and sustainability of small enterprises.

While a positive step, the Bank of Tanzania’s recent regulatory stance underscores the ongoing need for vigilant enforcement. Regular monitoring and evaluation of the impact of interventions will be instrumental in refining strategies and adapting to the evolving needs of small businesses.

In essence, the challenges faced by the Sabasaba liquor store owner serve as a call to action. By implementing a comprehensive strategy that combines regulatory measures, financial education, and technological advancements, we can strive towards a future where small businesses not only survive but thrive, contributing to the economic vitality of communities and fostering sustainable development.