The Federal Reserve’s decision to cut interest rates by 0.25 percentage points on December 18, 2024, reflects a complex and increasingly scrutinized strategy for navigating persistent inflation, a cooling labor market, and heightened global uncertainties.

The move, which lowered the benchmark rate to a target range of 4.25%–4.5%, is part of the Fed’s effort to stabilize financial conditions while balancing multiple risks. Inflation, while moderated from earlier peaks, remains elevated.

The Consumer Price Index (CPI) rose 2.7% year-over-year in November, up slightly from 2.6% in October, with core inflation—excluding volatile food and energy prices—holding steady at 3.1%.

These levels are well above the Fed’s 2% inflation target, signaling that inflationary pressures persist despite earlier rate hikes.

Federal Reserve Chair Jerome Powell defended the decision, calling it “the right call,” given the shifting dynamics of the economy. He acknowledged the evolving challenges by stating, “The calibration phase is now over. We are entering a new era of fogginess and unclarity at the moment” (Financial Times).

Powell emphasized the Fed’s focus on measured steps, noting, “Our focus remains on ensuring a measured approach, keeping inflation on track toward our 2% goal without introducing unnecessary volatility.”

He also hinted at a heightened reliance on economic data, signaling that upcoming monetary policy decisions will likely hinge on key jobs and inflation metrics, reflecting a shift to a more data-dependent approach.

Critics, however, have raised questions about the Fed’s current strategy. Steve Chiveron, a market commentator, described the central bank’s actions as “the worst performance since 2021.”

He pointed to what he characterized as a pattern of overreaction. “The Fed overreacted to labor market data in September, and now they’ve overreacted to inflation data,” Chiveron said.

ALSO, READ: Tax Reform in Tanzania: A Blueprint for Economic Equity and Growth

He argued that the Fed’s inconsistent approach has eroded market confidence and contributed to increased volatility.

This view is echoed by Research observing, “The Fed seems to have shifted from forecasting to becoming entirely data-dependent, reacting to short-term movements in data rather than maintaining a steady course.”

This prompts a warning that such a reactive stance could amplify market instability. I strongly believe that by being whipped around by short-term data, the Fed risks creating more uncertainty and jeopardizing its credibility.

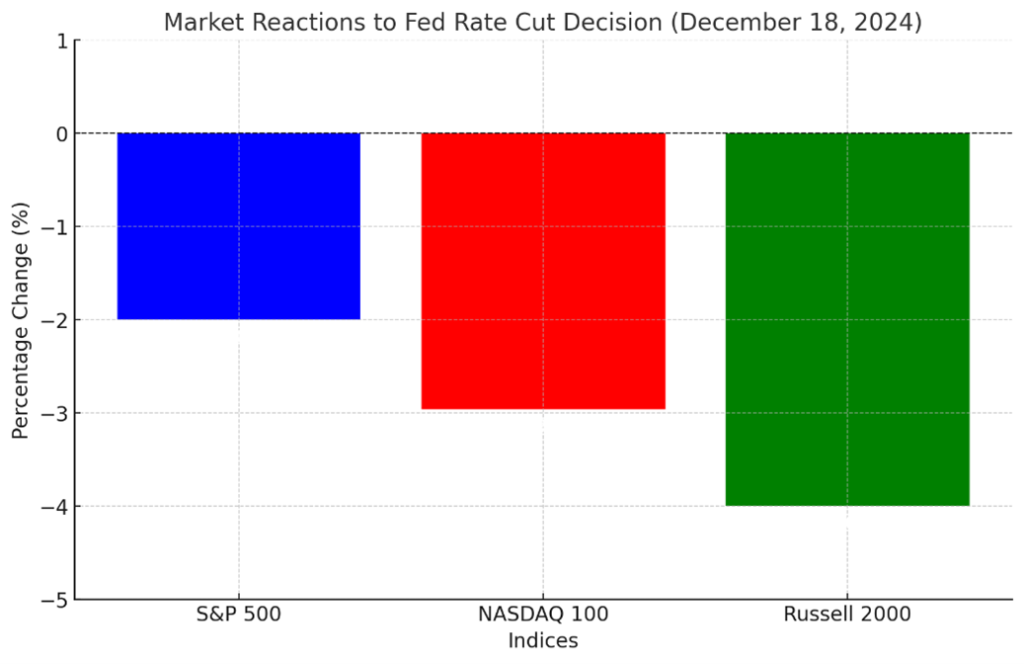

This uncertainty has translated into sharp market reactions. The S&P 500 dropped by 2%, marking one of its steepest declines in recent months, while the NASDAQ 100 fell 2.96%.

Small-cap stocks, reflected by the Russell 2000 Index, suffered the most, plunging nearly 4%.

The underperformance of small caps highlights growing investor concerns about the vulnerabilities of smaller companies in the face of tighter financial conditions and slower economic growth.

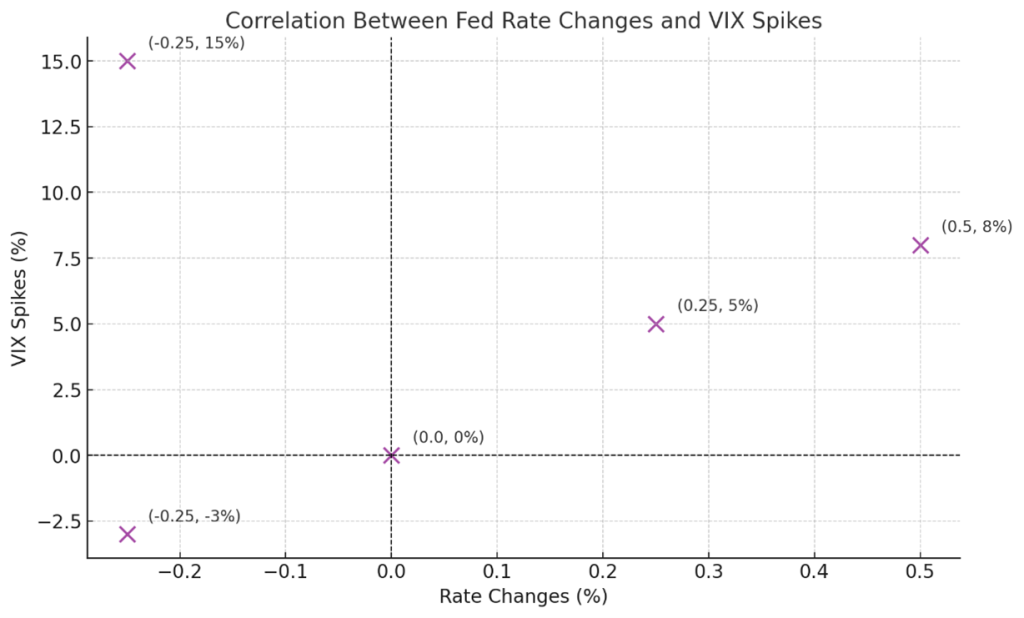

The VIX, Wall Street’s so-called “fear index,” spiked by 15% to 24.6, reflecting increased investor anxiety. Analysts have attributed this dramatic selloff to concerns about the Fed’s focus on inflation over providing conditions supportive of risk-taking.

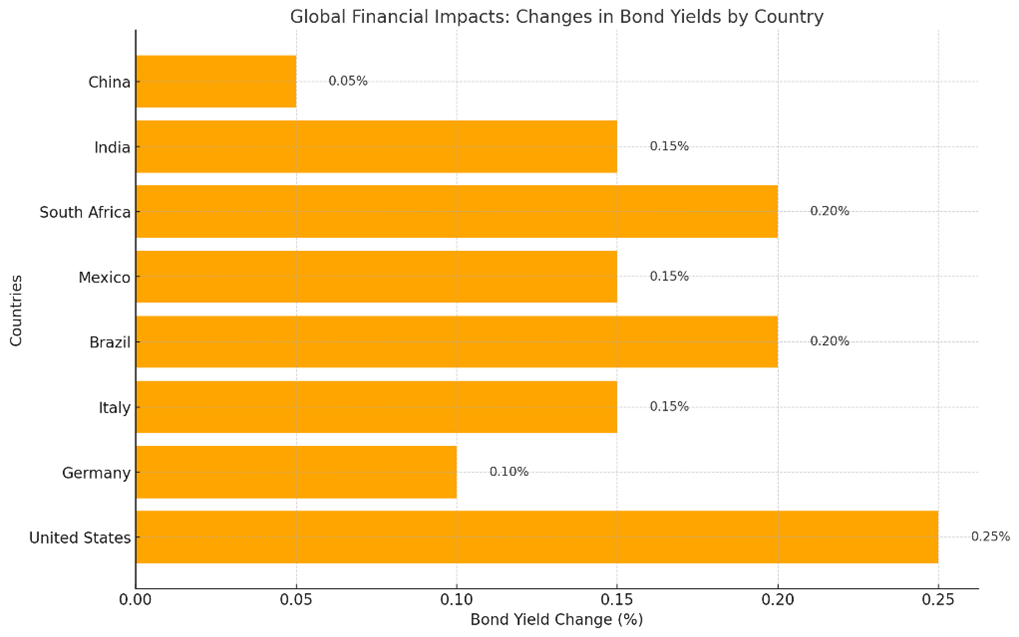

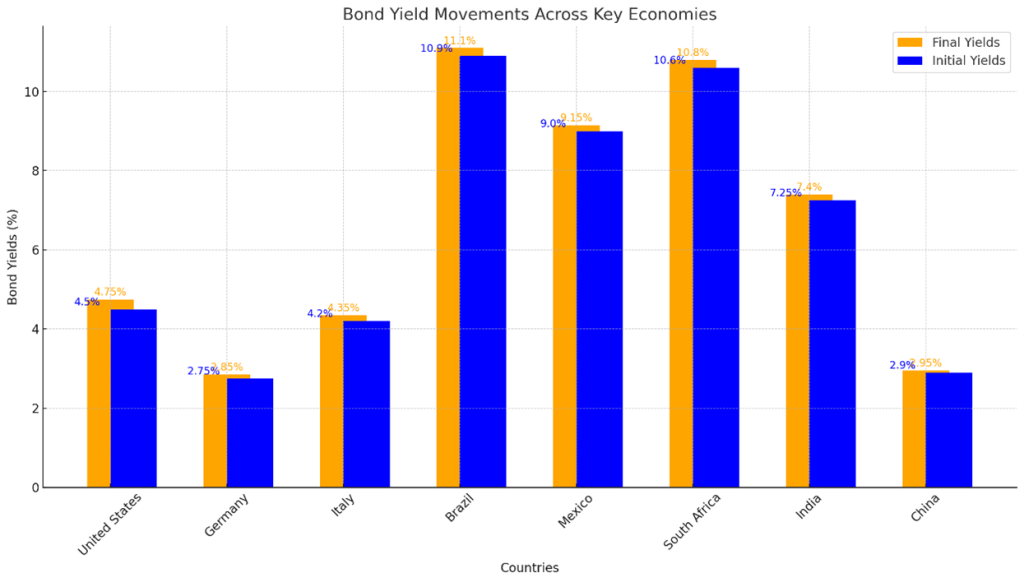

Global bond markets also reacted to the Fed’s decision. U.S. Treasury yields climbed sharply, with the 10-year yield rising to 4.75%, its highest level since October, as investors digested the Fed’s commitment to inflation control.

This rise in U.S. yields exerted upward pressure on sovereign bonds in other regions. In Europe, German bund yields increased by 10 basis points to 2.85%, while Italy’s 10-year bonds rose 15 basis points to 4.35%, reflecting heightened risk aversion toward peripheral economies.

In emerging markets, the impact was pronounced. Brazilian 10-year government bond yields rose 20 basis points to 11.1%, while Mexico’s climbed to 9.2%, as the stronger dollar and higher U.S. yields prompted capital outflows.

In Asia, China’s 10-year bond yields edged up to 2.95%, reflecting growing concerns about potential outflows due to the dollar’s strength.

India and South Africa also saw significant pressure, with their bond yields increasing to 7.4% and 10.8%, respectively, signaling the ripple effects of tighter U.S. financial conditions on BRICS economies.

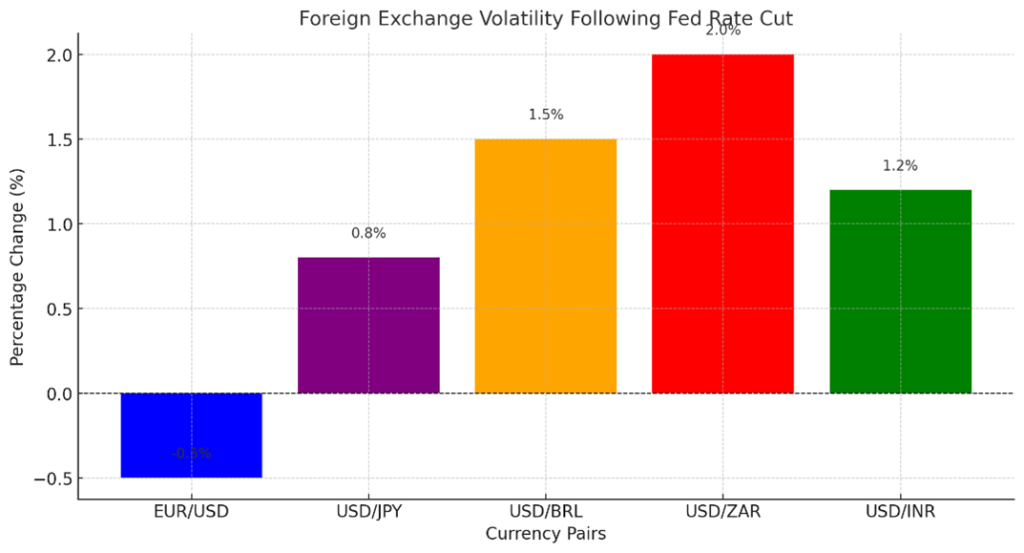

The foreign exchange market also saw volatility. The dollar index (DXY), which measures the greenback against a basket of currencies, climbed to 105.8, its highest level in six months.

The euro weakened by 0.5% to $1.06, while the Japanese yen depreciated by 0.8% to 148.3 per dollar ahead of the Japan Open.

Emerging market currencies were particularly hard hit, with the Brazilian real dropping 1.5% to 5.22 per dollar, the South African rand weakening 2% to 18.3 per dollar, and the Indian rupee falling 1.2% to 83.9 per dollar.

I highlight the significance of the upcoming Japan Open in the FX market, stating, “Yes, the dollar is much stronger, but how much oxygen is left up here?”

Jeffrey Rosenberg, a portfolio manager at BlackRock, provided a nuanced view on the implications for risk-taking in 2025.

He noted, “Markets had hoped for more leniency on the labor side, which would have supported financial conditions and encouraged risk-taking. Instead, by prioritizing inflation, the Federal is signaling a tighter stance.”

Rosenberg warned that this approach suggests the Federal may not reverse its policies quickly, creating unfavorable conditions for embracing market risk.

Sarah House, a senior economist at Wells Fargo, added a balanced perspective. “The decision seems to be a bit of both,” she said, referring to whether the Fed’s move was influenced more by data or political considerations.

“When you assess the magnitude of the change in relation to the balance of risks, there is a bit of recentering the risks of the forecasts between the projections stated by Powell during a press release done around midnight (EAT) on December 18, 2024, in Washington, DC.”

In summary, the Federal Reserve’s latest rate cut reflects its ongoing efforts to balance inflation control with a slowing labor market amid heightened economic uncertainty.

However, my critics tend to argue that the Federal appears “a little bit lost” in Q4, with its reactive stance contributing to dramatic selloffs in equity markets.

I believe the U.S. market is responding by not having direction, thus prompting investor unease.

The upcoming Japan Open in the FX market will be one to watch closely. Yes, the dollar is much stronger, but how much oxygen is left up here?

As global currencies, bond yields, and equities react to the Fed’s policy shift, the central bank’s ability to navigate domestic and international challenges will be critical in ensuring financial stability.

Powell characterized the moment as “an inflection point—a moment where our choices today will define our ability to ensure prosperity and stability in the years to come” (Financial Times).

Yet, the wide-ranging impacts on currencies, bonds, and market sentiment underscore the delicate and interconnected nature of managing U.S. monetary policy in today’s global economy.

As the Fed enters 2025, its ability to balance these priorities will be tested against the backdrop of a volatile and uncertain financial landscape.

Kelvin Msangi is a financial analyst. For suggestions, you can reach him at kelvin.msangi@protonmail.com or 0655963224.