Digital lending has rapidly transformed the financial landscape of East Africa, providing millions with easier access to credit through mobile platforms.

What began as a modest initiative has now become a multi-million-dollar industry driven by tech innovation and widespread mobile phone usage.

However, the sector’s growth has also raised serious concerns, particularly about predatory lending practices, exorbitant interest rates, and aggressive debt collection tactics.

In response, regulators in Tanzania, Kenya, and Uganda are strengthening regulations to curb these issues and foster a more transparent, fair digital lending environment.

In this article, we’ll take a closer look at the evolution of digital lending in East Africa, exploring its background, the current state of regulations, the different types of lenders out there, and what the future might hold for this exciting sector.

Background: The Rise of Digital Lending

Digital lending in East Africa began with partnerships between banks and mobile network operators (MNOs). These collaborations produced services like Kenya’s M-Shwari, a partnership between NCBA Bank and Safaricom, and Tanzania’s M-Pawa, a joint venture between Vodacom and the Commercial Bank of Africa (now NCBA).

These services enabled mobile money users to access small loans instantly without needing traditional bank accounts or credit histories. They proved immensely popular, providing much-needed financial services to previously underserved populations.

ALSO, READ: Card Payments in Tanzania: A Missed Opportunity or a Sign of a Deeper Trend?

Encouraged by the success of these bank-MNO partnerships, a second wave of non-bank digital lenders emerged. These fintech companies, such as Branch, Tala, and Laina, leveraged mobile technology to offer quick, unsecured loans directly to consumers through dedicated mobile applications.

Unlike traditional banks, these lenders operated with minimal regulatory oversight, allowing them to grow rapidly and capture a significant market share.

Current State: A Tale of Two Categories

Today, digital lending in East Africa can be broadly categorized into two groups:

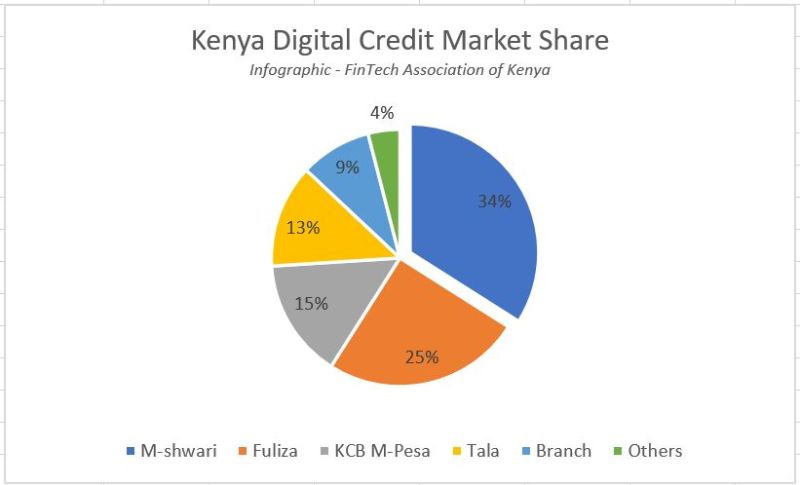

- Banks hiding behind mobile money operators: These are digital lending products offered on mobile money platforms co-created in partnership with licensed banks. Examples include Songesha, Fuliza, Mgodi, M-Shwari, KCB M-Pesa, Timiza, and M-Pawa.

Although these loans are marketed through MNOs, they are underpinned by banks, which handle the underwriting and bear the credit risk. This group operates under stringent regulatory oversight, as banks are already subject to comprehensive financial regulations, and such products always get no objection or product approval from the regulator.

- Non-Bank Digital Lenders offering loans on their own apps: This category includes fintech companies that are not traditional banks but have positioned themselves as agile, tech-driven lenders. Platforms like Branch, Tala, Laina, and Flexi Loan offer loans directly through their mobile apps.

These lenders have been the primary target of recent regulatory efforts due to their aggressive marketing, high interest rates, and sometimes unethical debt collection practices. In practice, they may even have two or 3 lending apps in the same markets, and the fouls they play are basically grey to black market malpractice or just abuse.

Regulatory Crackdown: Addressing the Gaps

The non-bank digital lenders, often operating in a regulatory grey area, have become the focal point of new legislative measures across East Africa.

While central banks already regulate banks and MNO-backed lenders, non-bank digital lenders have, until recently, operated with minimal scrutiny. This disparity has led regulators to intervene to level the playing field and protect consumers from predatory practices.

Kenya: Pioneering Regulation 🇰🇪

Kenya, where digital lending has arguably been most prolific, took early steps to regulate the sector. The Central Bank of Kenya’s (CBK) Digital Credit Providers Regulations 2021 now require all digital lenders to:

- Obtain a license from the CBK to operate.

- Disclose all loan terms, including interest rates and fees, before issuing loans.

- Adhere to strict debt collection guidelines to prevent harassment and abuse.

These regulations have forced many lenders to either comply or exit the market, significantly reducing the number of active digital lenders and curbing abusive practices.

Tanzania: Expanding Regulatory Scope 🇹🇿

In Tanzania, the Bank of Tanzania (BoT) has brought digital lenders under its purview through amendments to the Microfinance Act of 2018. This framework mandates that:

- All digital lenders must be licensed by the BoT, with severe penalties for non-compliance.

- Interest rates are capped, and lenders must disclose all fees associated with their loans.

- A centralized registry of all licensed digital lenders has been established, providing consumers with a way to verify legitimate lenders.

This regulatory push has particularly targeted non-bank digital lenders, whose practices have been viewed as more exploitative compared to the more regulated bank-MNO offerings.

Uganda: Laying the Groundwork for Regulation 🇺🇬

Uganda’s regulatory framework is still evolving, but the Bank of Uganda (BoU) has signalled its intent to regulate digital lenders more rigorously. Proposed measures include:

- Licensing requirements for all digital lenders, bringing them under the supervision of the BOU.

- Transparency in loan pricing and terms, focusing on protecting borrowers from hidden fees and high interest rates.

- Restrictions on debt collection practices to ensure ethical treatment of borrowers.

Why Non-Bank Lenders Fintechs Are the Focus?

The crackdown on non-bank digital lenders stems from several key concerns:

- Market Share and Competition: Non-bank lenders have rapidly gained market share, often by undercutting traditional banks and MNO-backed products. Their aggressive marketing and quick loan disbursements have drawn in many borrowers. That might have pissed off the incumbents and alerted the bigwigs to make some calls, I mean tough calls.

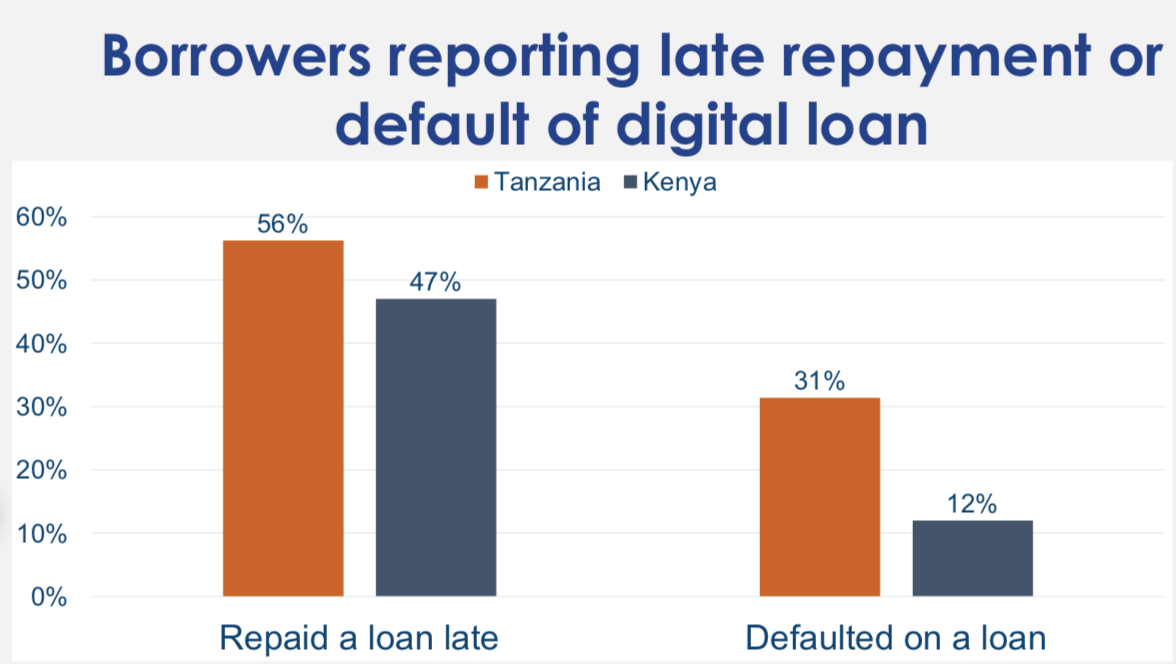

- Predatory Practices: High interest rates, hidden fees, and unethical debt collection tactics have raised the alarm. These practices harm consumers and threaten the reputation of the entire digital lending sector.

- Data Privacy Issues: Non-bank lenders often use borrower data for credit scoring without clear consent, raising significant privacy concerns. I know this one was getting political, and we love a topic for the next election campaign.

In contrast, banks and MNO-backed lenders are seen as more stable and compliant with existing regulations. As such, they have not faced the same level of scrutiny, though they are not entirely exempt from the new regulatory stance, In Tanzania they are.

The Future of Digital Lending Fintechs: Neobanks, Super Apps, and Beyond

The regulatory tightening across East Africa is likely to reshape the digital lending landscape significantly. As the market matures, we can expect to see several key trends emerge:

- Transformation into Neobanks: Some digital lenders are already evolving into neobanks, offering a broader range of financial services beyond loans. Branch, for example, is expanding into savings and investment products, positioning itself as a one-stop financial service provider.

- Become Super Apps: Others may evolve into super apps, integrating various financial and non-financial services into a single platform. This model, popularized in Asia, could see digital lenders expanding into payments, e-commerce, and insurance, leveraging their existing customer base and technological infrastructure.

- Unbundling of Services: In response to regulatory pressures, some digital lenders might choose to unbundle their services, specializing in specific niches like credit scoring, payment facilitation, or partnering with traditional banks to offer more compliant loan products. Look at what Kuunda or Credable is doing, and I guess that is somehow not really termed digital lending. It is incredible tech and partnership coupled with a genius business model.

The evolution of digital lending in East Africa is a story of rapid growth, innovation, and, now, regulatory recalibration. As regulators in Kenya, Tanzania, and Uganda take stronger measures to protect consumers, the sector is poised to enter a new phase of development—one that prioritizes sustainability and fairness over unchecked expansion.

Adapting to this new reality will be crucial for digital lenders. Those who can navigate the evolving regulatory landscape while continuing to innovate will survive and thrive, potentially transforming into the neobanks and super apps of the future.

As the dust settles, the ultimate winners will be the consumers, who will benefit from a safer, more transparent, and more inclusive financial ecosystem.