Yesterday, I found myself browsing through the Uongozi Institute’s website. I still don’t know why, but that is not important. What’s important is what I found. As I scrolled, a particular report caught my eye: “Implementation of local content regulation: The case study of a foreign-owned mining operation in Tanzania,” authored by Jambo Ramadhani and Emmanuel Maliti.

Intrigued, I decided to delve deeper. Stumbling upon this report was like finding a hidden track on your favorite album. You didn’t know it was there, but now it’s your new jam, and you can’t stop talking about it. So, allow me to talk about it, the report was well written, and the findings on Local content challenges in Tanzania’s mining sector were enlightening and thought-provoking.

Local content initiatives are not new. They’ve been conceptualized globally to foster socio-economic growth, address unemployment, boost private sector development, and advance local workforce capabilities. Like many resource-rich countries, Tanzania has embraced LC measures, especially in its mining sector. But the question remains: Are these regulations achieving their intended purpose?

But first, a little description of the term so that we can be on the same page, and also a chance to showcase what I learned.

Imagine you’re throwing a big party in your home. Instead of ordering drinks, food, and music from faraway places, you decide to get everything from local shops and corner DJs. By doing this, you’re supporting your neighbors, helping local businesses grow, and ensuring the money you spend stays in your community. This idea of using and supporting local resources and people is what we call “local content.”

The report provides a comprehensive analysis of the implementation of local content (LC) regulations in Tanzania, focusing on the mining sector.

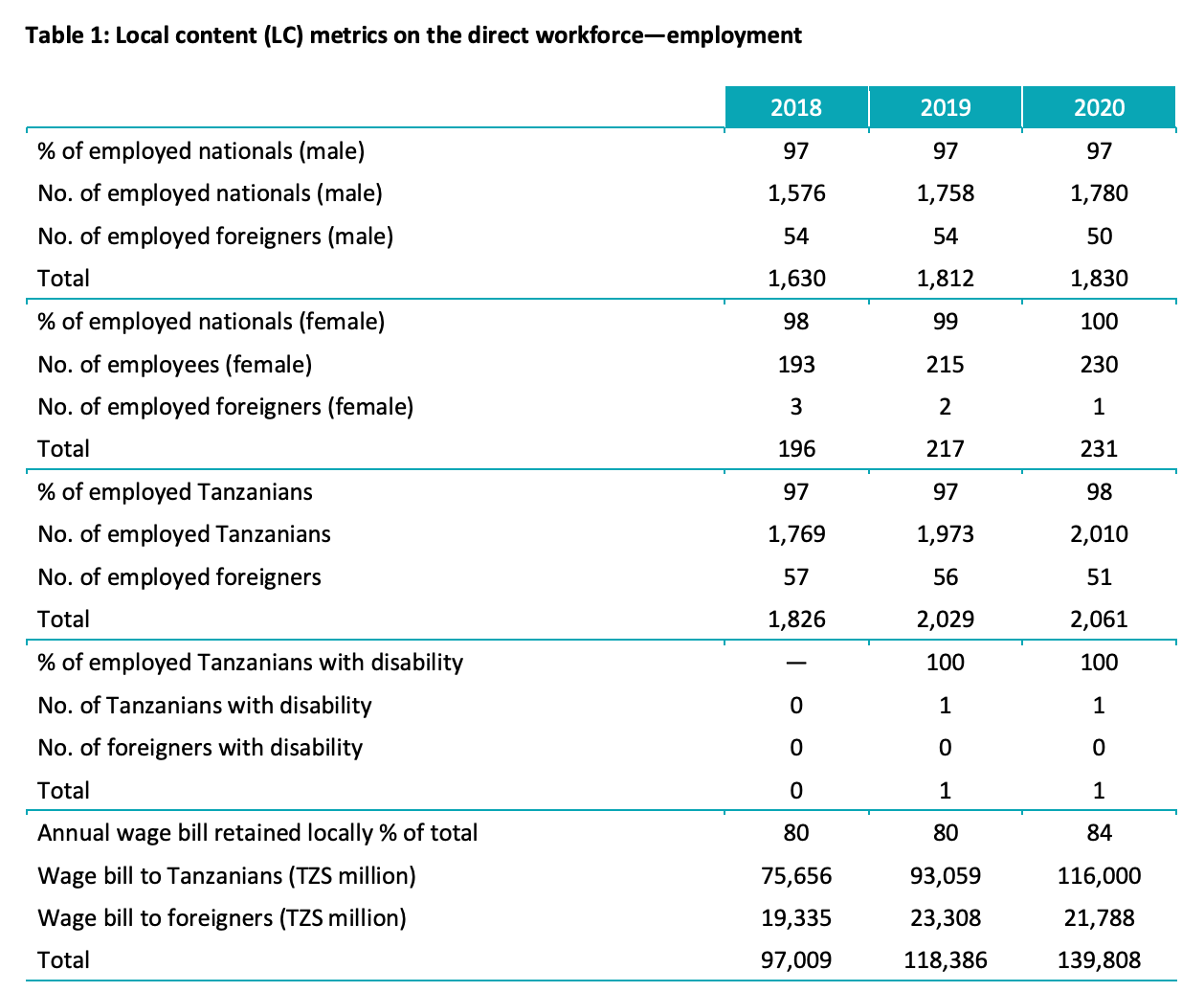

The report’s case study on an anonymous mining company in Tanzania revealed some promising statistics. I understand why the company chose to remain anonymous; you are welcome to form your own opinion on this. In this company, Tanzanian nationals constituted as much as 98% of the company’s total workforce by 2020. This is commendable, especially compared to averages from other mining companies in countries like Nigeria and Ghana.

The report on Tanzania’s mining sector is a goldmine (pun intended) of insights. The wage share for Tanzanian nationals increased from 80% in 2018 to 84% in 2020. These figures suggest that the company is not only employing locals but also compensating them fairly.

However, while these numbers are encouraging, much like my dating life in secondary school, it’s complicated. On one hand, we see Tanzanian nationals making up a whopping 98% of the workforce in the studied mining company. On the other hand, the dominance of Tanzanian nationals in the force could be attributed to their prevalence in low to medium-skilled positions.

For example, In 2020, while Tanzanian nationals made up a staggering 98% of the workforce in the studied mining company, they captured 84% of the company’s wage bill. Which means 16% of wage bill goes to only 2% of workers who happens to be foreign. It’s essential to note that while the majority of the wage bill is retained locally, the disparity in the percentage of the workforce versus the wage bill indicates that, on average, foreign employees are earning more than their Tanzanian counterparts. This could be attributed to the roles they occupy, their expertise, or other factors not detailed in the report. With the looming threat of automation in mining, which reduces the need for low-skilled labor, will these numbers remain sustainable in the future?

Challenges in Implementing Local Content Regulations

While the report paints an optimistic picture of the strides made in implementing local content regulations in Tanzania’s mining sector, it doesn’t shy away from highlighting the challenges faced. The Tanzanian government has set an ambitious target to boost the mining sector contribution to the country’s Gross Domestic Product (GDP) to 10 percent by 2025. This goal is part of Tanzania’s Development Vision 2025, a long-term plan aimed at transforming the country into a semi-industrialized nation by 2025. These challenges, if not addressed, could hinder the full realization of the benefits of local content initiatives.

- Dishonesty Among National Employees: One of the significant issues raised in the report is the dishonesty observed among some national employees. Having dishonest employees in the mix is like trying to bake a cake with salt instead of sugar. It looks fine on the outside, but one bite and you realize something’s terribly off. This behavior has eroded investors’ trust in the local workforce, limiting opportunities for Tanzanians to occupy sensitive positions. Such ethical concerns, if widespread, could deter foreign investments and partnerships.

- Weak Private Sector: The report identifies a weak private sector as a root cause of sub-optimal local content in the mining industry. This weakness has resulted in a limited domestic industry capable of producing essential equipment and materials for the mining sector. Even when local suppliers exist, many lack the necessary technical skills and capacities to serve the sector effectively.

- Mismatch Between Education and Industry Needs: There’s a disconnect between the education provided by technical colleges and the evolving technologies and business models in the mining sector. This mismatch has resulted in a scarcity of skills required by the industry, such as underground mining skills. Think of it this way “Mismatch Between Education and Industry Needs is like training for years to become a top-notch chef and then being told you’re only needed to make ‘maandazi.’ The skills are there, but they’re not matching the job at hand.”

- Challenges in Joint Ventures: While joint ventures between local and foreign vendors have shown potential in retaining mining sector benefits locally, their success has been limited. Local vendors often claim high-profit margins, operate informally, and sometimes even ignore tender announcements under the mistaken belief that mining companies have preselected suppliers.

- Limited Technological Integration: Local professional service providers, including auditors and insurers, struggle with the complexity and volume of mining operations. In comparison to international banks, local banks lag in offering advanced online banking services, which stems from the overall underdevelopment of the financial sector.

- Regulatory Challenges: The capacity of regulatory agencies to monitor and enforce local content implementation is constrained. There’s a lack of efficient systems to verify the ownership of companies supplying mining operations, and many mining companies aren’t subjected to audits that would ensure adherence to local content processes.

- Data Gaps: A significant challenge highlighted is the lack of data on the foreign components of the direct workforce and procurement. This absence of data makes it difficult to assess the true extent of local content implementation and its impact. For clarity, imagine you aim to complete a puzzle with half the pieces missing. You can see parts of the picture, but the full image remains elusive.

Solutions to Enhance Local Content Implementation

While significant, the challenges in implementing local content regulations are not insurmountable. Addressing them requires a multi-faceted approach, combining policy reforms, industry initiatives, and educational interventions. Here are some potential solutions to enhance the effectiveness of local content regulations in Tanzania’s mining sector:

- Strengthening Ethical Training: To address the issue of dishonesty among national employees, there’s a need for comprehensive ethical training programs. These programs should be integrated into the educational curriculum and company training modules, emphasizing the long-term benefits of ethical conduct for individuals and the nation.

- Empowering the Private Sector: Efforts should be made to strengthen the private sector, particularly mining-related industries. This can be achieved through financial incentives, capacity-building programs, and fostering partnerships between local and international firms.

- Bridging the Education-Industry Gap: Collaborative initiatives between educational institutions and the mining industry can help align the curriculum with industry needs. Regular industry-academia dialogues, internships, and on-the-job training programs can ensure that graduates are equipped with skills in demand.

- Facilitating Successful Joint Ventures: The government can ensure that joint ventures between local and foreign vendors are more successful. This can be achieved by providing clear guidelines, ensuring transparency in tender processes, and offering mediation services in case of disputes.

- Investing in Technological Advancements: Encouraging investments in technology can help local service providers better cater to the mining industry. This includes advanced online banking services, digital platforms for procurement, and technological training programs tailored for the mining sector.

- Enhancing Regulatory Oversight: Strengthening the capacity of regulatory agencies is crucial. This can be achieved by providing them with the necessary resources, training, and technology to monitor and enforce local content regulations effectively.

- Data Collection and Analysis: Establishing a centralized database that captures information on the foreign components of the workforce and procurement can provide valuable insights. Regular audits and surveys can ensure that this database is up-to-date and can serve as a tool for policymakers and industry stakeholders.

- Public Awareness Campaigns: Raising awareness about the importance and benefits of local content regulations can foster a sense of ownership and pride among Tanzanians. Such campaigns can also educate local suppliers about opportunities in the mining sector and the standards they need to meet.

- Feedback Mechanisms: Establishing feedback mechanisms where companies can share their challenges and successes in implementing local content regulations can provide valuable insights. These platforms can facilitate knowledge sharing and best practices among industry players.

Policy Recommendations to Address Local Content Challenges in Tanzania’s Mining

Finally, the study provides a comprehensive set of policy recommendations aimed at enhancing the effectiveness of local content regulations in Tanzania’s mining sector:

- Regulatory Reforms:

- Joint Ventures (JVs): The Mining (LC) Regulations 2018 should be revised to:

- Reconsider the current minimum limit of at least 20% local ownership.

- Permit JVs to involve multiple local companies.

- Allow JVs to be formed based on intended business rather than total company shares.

- Enable JVs to raise capital through the Dar es Salaam Stock Exchange.

- Harmonization and Clarity:

- Align varying definitions of a local company across different regulations.

- Streamline the approval process for investors’ submissions, holding regulators accountable for timely responses.

- Minimize the extensive LC-related reporting.

- Incorporate a mining industry representative in the LC committees.

- Provide more straightforward guidelines on technology transfer.

- Ensure consistency across governing instruments on LC in Tanzania.

- Joint Ventures (JVs): The Mining (LC) Regulations 2018 should be revised to:

- Coordination and Promotion of Local Content:

- Education and Awareness:

- Educate the business community on JV opportunities in the mining sector.

- Advocate for the inclusion of work ethic training in the education sector.

- Capacity Building:

- Facilitate JVs by presenting selected local vendors to foreign vendors in a competitive bidding process.

- Invest in exchange programs between Tanzania and advanced countries to enhance local capacities in both technical and managerial mining roles. Co-creating such programs with mining companies and the government is a potential alternative.

- Education and Awareness: