Withholding Tax is the amount of money a taxpayer withholds from gross payments for relevant services/goods to his/her supplier. It is the amount of money short-paid to the supplier. This amount so withheld is then required to be paid to the Tanzania Revenue Authority (TRA) on behalf of the supplier.

Once paid, the supplier should be provided with a Withholding Tax certificate, which can be digitally downloaded from TRA’s portal. The person/entity withholding the tax and remitting it to TRA on behalf of the supplier is termed as “withholder” or “withholding agent” and the supplier who suffers the short payment is termed as “withholdee”.

This act of withholding is a requirement of the law: Income Tax Act, which clearly stipulates the processes and procedures for doing so.

The amount so withheld from payments to relevant suppliers is then used by these suppliers to offset their Corporate Tax/Income Tax liabilities towards the Tanzania Revenue Authority at the end of the related financial year.

Also, read: Unfair Taxation or Necessary Evil? The Kariakoo-TRA Conflict: Where Are We Messing Up?

We often see taxpayers who are audited by the Tanzania Revenue Authority being assessed for Withholding Taxes because they did not withhold the relevant amount from relevant payments to suppliers.

Did you know that by Section 84(6) of the Income Tax Act (R.E. 2019), the principal tax stated in these assessments is recoverable by law from the suppliers directly thereby reducing the tax burden for the assessed party (the withholder)?

(6) A withholding agent who fails to withhold income tax under Subdivision A but pays the tax that should have been withheld to the Commissioner in accordance with subsection (3) shall be entitled to recover an equal amount from the withholdee.

To ensure a smooth recovery procedure through a legal representative or via mutual understanding, the withholder should ensure that TRA’s audit report (or Notes of Discussion) clearly states the breakdown of assessed Withholding Tax withholdee-wise.

For the avoidance of doubt, tax interest imposed by TRA on the withholding agent for failure to withhold tax cannot be recovered from the withholdee. Only the principal tax can be recovered.

Most importantly, this tax to be recovered from the witholdee will again not be a cost burden for the withholdee. It can be used to offset any outstanding Corporate Tax/Income Tax of the withholdee towards TRA. Therefore, withholdees should ideally not object to refunding this tax to the withholder.

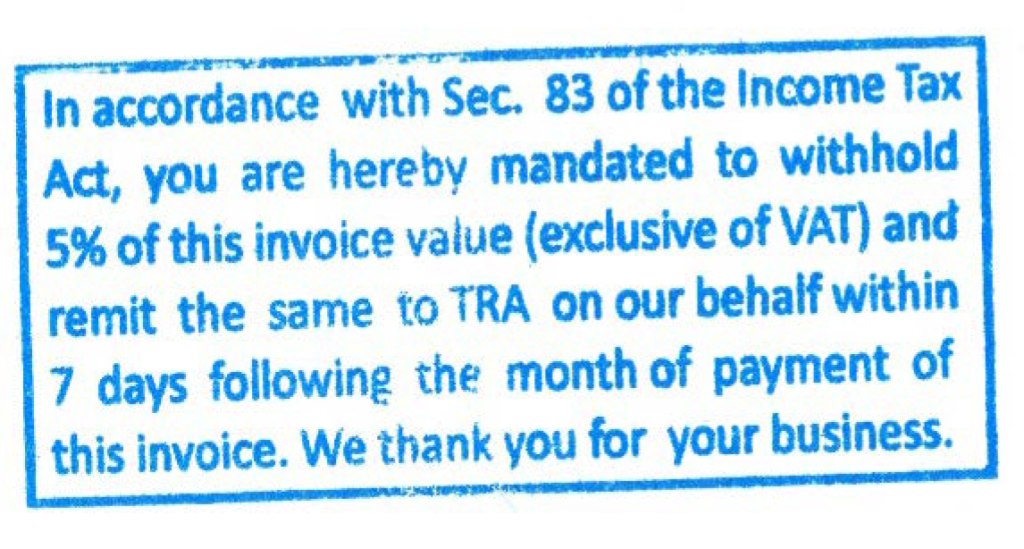

To avoid this confusion and unnecessary inconvenience of Withholding Tax recoveries, all withholdees when raising invoices for payments to their customers must expressly remind their customers to withhold the relevant tax from the payments.

This can be mentioned explicitly on the face of the tax invoice. An example of the same is reproduced hereunder:

Caveat

The professional opinion expressed herein is subject to change based on changes in relevant Tanzanian Tax Laws and Regulations. The information contained herein is for implementation guidance only and does not substitute the relevant Tanzanian Tax Laws and Regulations.