In the ever-evolving world of global finance, getting lost in the noise of saturated markets is easy. Yet, occasionally, a beacon of opportunity emerges, signaling a promising horizon for investors. This month, that beacon is Tanzania. The Tanzania Investment Centre (TIC) Monthly Investment Factsheet of August 2023 paints a picture of a rising nation.

With a GDP growth rate of 3.3% and an inflation rate of 5.6%, Tanzania is demonstrating economic resilience. While these numbers are commendable, they are not just statistics on a page. They represent the culmination of policy decisions, infrastructural developments, and a burgeoning entrepreneurial spirit.

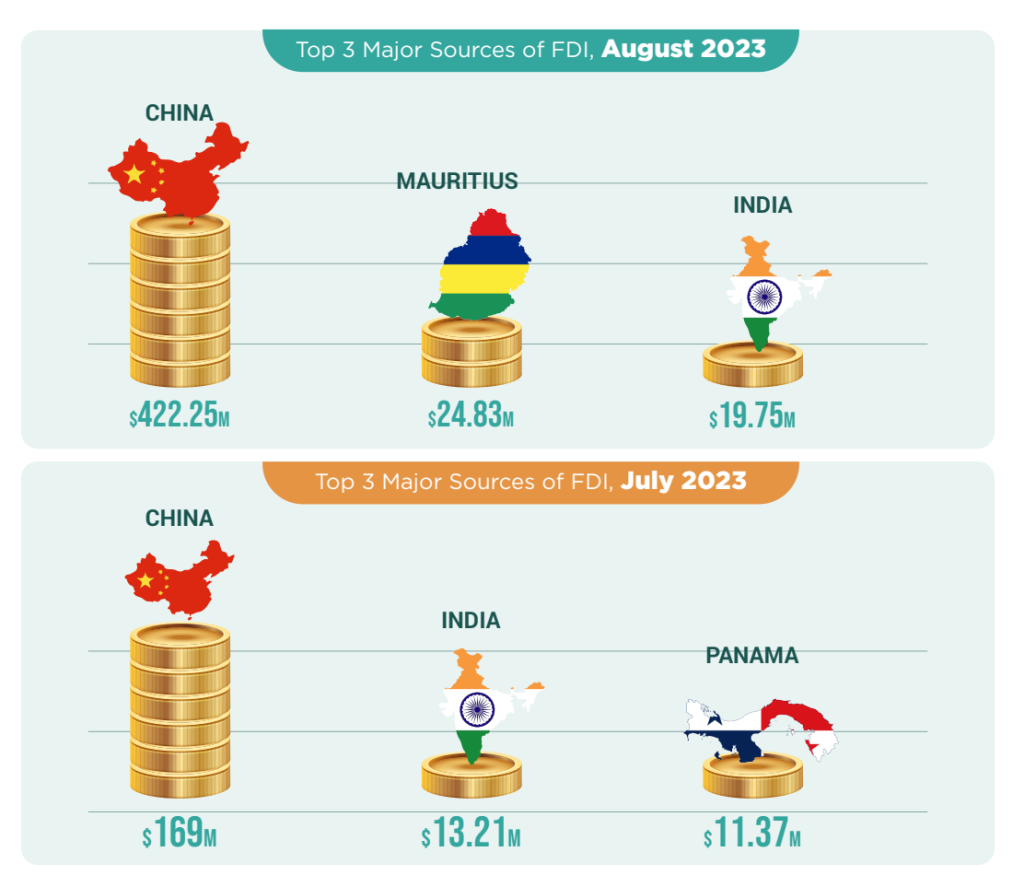

Foreign Direct Investment (FDI) – The China Influence

Historically known for its expansive Belt and Road Initiative, China continues to be a dominant player in Tanzania’s FDI landscape, investing a whopping $422.25M in August 2023. Mauritius and India follow, but the gap is significant, signaling China’s vested interest in Tanzania’s growth story.

The increasing influence of China in Tanzania can be understood in the context of a broader shift in Africa from a focus on aid to investment. Western nations have traditionally been significant aid donors to African countries. However, this aid often comes with various strings attached, such as requirements to implement specific policies. This has led to a growing disillusionment with Western aid in Africa and a desire for investment that can help drive economic growth without imposing unwanted conditions.

Conversely, China has been stepping in to fill this gap by offering investments with different conditions attached. This approach is exemplified by China’s Belt and Road Initiative (BRI), a massive infrastructure development project that aims to improve connectivity between Asia, Africa, and Europe. Tanzania is one of the countries that has been a significant beneficiary of this initiative and as it shows, China Dominates Tanzania’s FDI Landscape.

The TIC report show that the investment is not just in terms of money but also includes technology transfer, skill development, and opening doors to other Asian markets. This investment is crucial for developing Tanzania as it helps build the necessary infrastructure, improve the workforce’s skills, and create opportunities for Tanzanian businesses to access new markets.

This is not an isolated event; According to a recent article from The Exchange, trade between China and Tanzania grew by 23.7% year-on-year in 2022, reaching US$8.31 billion, 3.5 times more than in 2012. The same article also mentions that China is Tanzania’s largest trading partner and most significant source of foreign investment to date, which coincides with the above information found in this month’s TIC report.

Another article from TanzaniaInvest states that China is Tanzania’s first trading partner and investor. In 2021, Tanzania imported roughly TZS 6,207 billion (around USD 2.7 billion) of goods and services from China, while it exported to China USD 606 million. Business Insider Africa reports that China and Tanzania signed a $2.2 billion railway construction deal in December 2022. The rail line is intended to cross the borders. The significant investment from China signals its vested interest in Tanzania’s growth story.

It is not just about the economic benefits that China gains from investing in Tanzania but also about strengthening the political and economic ties between the two countries. China’s approach to investment in Tanzania and other African countries is often seen as a win-win situation, as it helps to drive economic growth in the host countries while also creating opportunities for Chinese businesses.

Sectoral Insights: Building, Services, and Manufacturing

Commercial building leads the FDI sector, with an investment of $304.86M. This indicates a country laying down its infrastructural bedrock, a sign that Tanzania is preparing for a future of urbanization and modernization. The services and manufacturing sectors are just slightly behind, signaling a balanced and diversified growth approach.

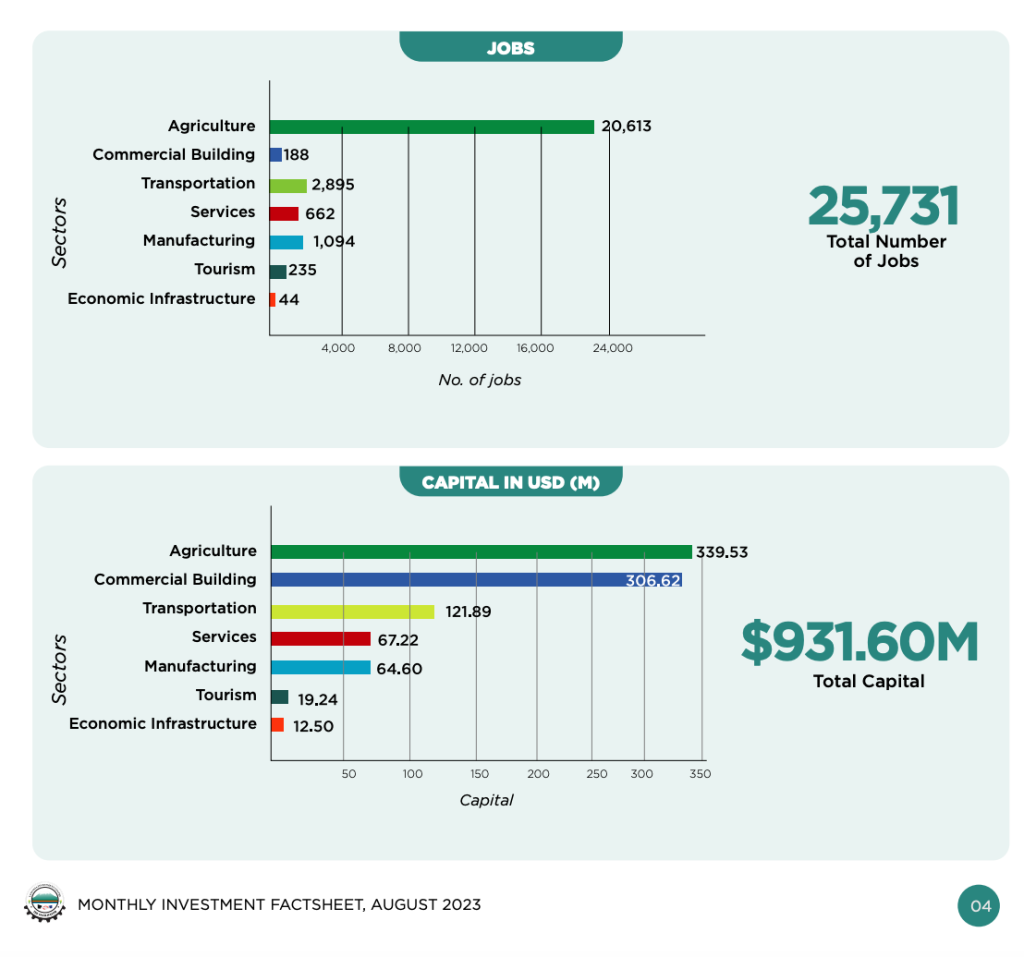

Domestic Investments – Agriculture Takes the Lead

While FDI is crucial, domestic investment is the backbone of any economy. It’s heartening to see agriculture, the primary sector, receiving the lion’s share of domestic investments at $328.88M. This ensures food security and indicates a focus on export-led growth in the agricultural industry.

Job Creation – A Testament to Inclusive Growth

One of the most promising indicators from the report is the job creation numbers. Agriculture alone created over 20,000 jobs in August 2023. Such numbers testify to Tanzania’s inclusive growth strategy, ensuring economic progress trickles down to its vast population.

Future Projections: Tanzania in the Next Decade

Tanzania’s trajectory is promising for the next 5-10 years. With a robust GDP growth rate of 3.3% and a burgeoning investment landscape, the nation is poised for a transformative decade ahead. Here’s what we can anticipate:

- Economic Diversification: As Tanzania continues to attract investments across various sectors, from agriculture to commercial building, we can expect a more diversified and resilient economy. This diversification can act as a buffer against global economic shocks.

- Urbanization and Infrastructure: With significant investments in the commercial building sector, urban centers in Tanzania are likely to see rapid development. This urban growth and government initiatives might lead to improved infrastructure, connecting major economic hubs and facilitating trade.

- Human Capital Development: The emphasis on job creation, especially in sectors like agriculture, indicates a focus on inclusive growth. Over the next decade, we can anticipate a more skilled and educated workforce ready to drive the nation’s industries.

- Regional Leadership: Given its strategic location and growing economy, Tanzania might emerge as a regional leader in East Africa, setting benchmarks in investment policies, sustainable growth, and infrastructural development.

While the numbers are promising, Tanzania will face challenges like any emerging market. The nation will need to ensure that its regulatory environment remains investor-friendly. The increase in permits and licenses issued in August 2023 is a positive sign, but the bureaucracy needs to ensure efficiency and transparency.

Furthermore, with significant investments in sectors like commercial building and agriculture, there’s a need for a parallel focus on sustainability. Environmental considerations should be at the forefront to ensure long-term, sustainable growth.

Although China Dominates Tanzania’s FDI Landscape, the narrative is unfolding for other global investors, and the next chapter promises even more excellent opportunities. As the nation stands on the cusp of significant economic transformation, now is the chance to delve deeper, understand its potential, and be a part of its growth story.

We encourage potential investors to consider Tanzania a pivotal addition to their portfolios. Dive into detailed research, engage with local experts, and explore the myriad opportunities this East African gem offers. You can start by joining our Newsletter here if you like. Every day, you will receive important updates about Tanzania.