Africapitalism, a philosophy championed by Tony Elumelu, emphasizes the private sector’s transformative power in driving economic growth and social progress across Africa.

It calls for businesses to go beyond profit-making and invest in the continent’s long-term development. As Africa stands on the cusp of a digital revolution, the principles of Africapitalism are more relevant than ever.

The true potential of this philosophy lies in building an interconnected digital economy where technology and innovation are harnessed to empower millions and foster sustainable growth.

The world progresses faster on digital first asset-light models like Zoom and Uber.

Uber still runs on available roads, Zoom runs on AWS and Azure, and they use smartphones that run on electricity and internet connections built many years back.

The asset-light business model allows companies to focus on their core competencies and innovation without investing heavily in physical infrastructure.

However, that is true only when that infrastructure exists; unfortunately, in most of Africa, no such infrastructure is needed.

I think, To build Africa’s infrastructure we need at least $500 Billion in patient capital, look at what AfDB estimates and to understand that we need over $100 billion on data centre infrastructure alone. Now add the roads, rails, airports, satellites and ports.

A key enabler of this vision is a unified digital stack that seamlessly connects the continent’s diverse financial systems, national payment switches, and data networks.

However, achieving this level of interoperability requires more than technological advancements—it demands significant investments in infrastructure.

Africa will need billions of dollars in government and private sector funding to create a robust and inclusive digital ecosystem.

This is a call to action for governments, financial institutions, and businesses to collaborate and build the digital infrastructure that will pave the way for a prosperous and connected Africa.

In an age where digital transformation drives economies and connects communities, Africa finds itself at a pivotal moment. The continent is brimming with potential yet faces significant barriers in connectivity, financial inclusion, and data sharing.

ALSO, READ: Can Credit Scoring Unlock Financial Growth in Sub-Saharan Africa?

To unlock its full potential, Africa must prioritize infrastructure development as the cornerstone of a digitally inclusive future.

From subsea cables to payment systems and agent networks, infrastructure is the backbone that can support Africa’s leap into a connected, prosperous, and inclusive digital age.

Hundreds of Billions of dollars in patient capital allows builders to think big enough to create new industries and revolutionise the ones we have.

I would like to explore key infrastructure opportunities where the private sector if billions of dollars are directed, would add value and help revolutionise.

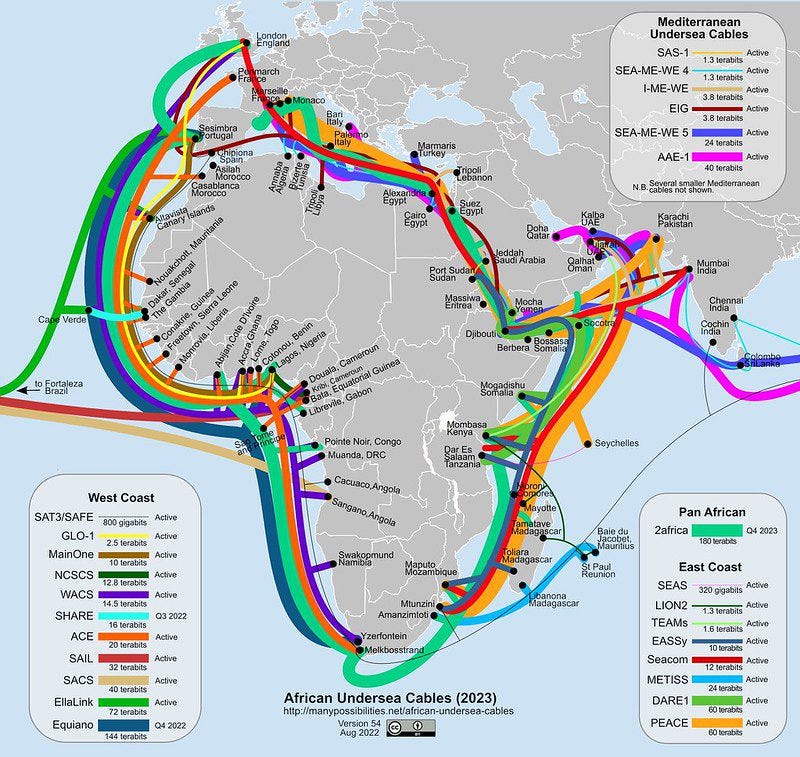

Subsea Cable Revolution: Connecting Africa to the World

The installation of subsea cables along Africa’s coasts has been a game-changer. In East and West Africa, these cables have dramatically improved internet speeds, reduced costs, and enabled millions to access the digital world.

However, recent disruptions made the fragility of these networks evident, underscoring the need for more resilient infrastructure.

Lesson Learned: Africa needs to diversify its connectivity options. Investing in more cables and ensuring redundancy can prevent outages that disrupt economies and lives. The goal should be to connect Africa to the world and ensure that this connection is robust and reliable.

PIX and UPI: Public Digital Payments Infrastructure as a Catalyst for Inclusion

Brazil’s PIX and India’s Unified Payments Interface (UPI) have transformed their respective financial landscapes, making digital payments accessible to millions who previously had limited financial services.

These government-backed systems provide a blueprint for Africa, demonstrating how public digital infrastructure can drive financial inclusion, reduce transaction costs, and spur economic activity.

Call to Action: Africa should build on the success of the Pan-African Payment and Settlement System (PAPSS) to create a unified, continent-wide payment system.

Such an infrastructure would enable seamless cross-border transactions, foster trade, and empower small businesses across the continent.

Starlink: Balancing Connectivity with Data Protection

The arrival of Starlink in Africa promises to connect remote and underserved areas with high-speed internet. Yet, the focus must not solely be on connectivity; data protection and sovereignty are equally crucial.

Starlink and similar ventures should operate within frameworks prioritising African data rights and sovereignty, ensuring that the benefits of connectivity do not compromise privacy and security.

Strategic Priority: African countries must develop and enforce strong data protection laws to safeguard their citizens in the digital age. Connectivity should empower people, not expose them to new risks.

Visa and Mastercard: The Limits of Global Payment Systems

The suspension of Visa and Mastercard services in Russia following the Ukraine war was a stark reminder that global financial networks are not neutral.

Despite their reach, these systems are bound by the geopolitical interests of their home countries. This situation calls for Africa to rethink its dependency on external payment systems and consider building resilient, local alternatives.

Vision for Africa: Developing a pan-African card scheme and strengthening PAPSS can provide the continent with payment systems that prioritize African interests and reduce dependency on external networks.

Reliance Jio: Infrastructure as a Catalyst for Digital Growth

Reliance Jio’s rapid deployment of 4G infrastructure in India transformed the country’s digital landscape, bringing affordable internet to over 500 million people in just seven years.

This strategic investment in infrastructure didn’t just boost data consumption; it revolutionized industries and created new opportunities for millions.

Inspiration for Africa: Similar large-scale investments in digital infrastructure could revolutionize internet access and affordability across Africa, bridging the digital divide and driving economic growth.

Rails and Airports: Blocks of Economic Powerhouses.

The Chineses are pouring billions into Africa because they know for a fact China’s meteoric rise as global economic powerhouse is underpinned by their investments in physical infrastructure.

Modern roads, efficient railways, and world-class airports have facilitated trade and attracted global businesses and tourists, creating vibrant, interconnected economies.

Africa’s Path Forward: Investing in digital and physical infrastructure must go hand in hand. A robust network of roads, rails, and airports can support the movement of goods and people, while digital infrastructure connects businesses and consumers in the digital economy.

Agents: Transforming Mobile Money into a Public Utility

Agent networks have been the backbone of Africa’s mobile money revolution, providing a critical interface between digital financial services and cash-based economies.

However, their potential is far from fully realized. By transforming agent networks into a shared public utility accessible to all players, big and small, we can unlock a new wave of innovation in financial services, e-commerce, and digital business.

Policy Recommendation: Governments should support the development of a shared agent infrastructure that can serve as a public utility. This would reduce costs and enable greater financial inclusion and competition.

More Cables, More Satellites: Democratizing Internet Connectivity.

A few multinational corporations should not control Internet connectivity in Africa. By investing in more subsea cables and satellite networks, African nations can ensure that connectivity is reliable, affordable, and aligned with national interests.

This strategy will help democratize internet access, making it a public good rather than a corporate commodity.

Future Outlook: A truly connected Africa is one where the internet serves the needs of its people, not just the bottom line of global corporations. Investment in diverse connectivity options will be key to achieving this vision.

Credit Scoring and Shared Data: A Realistic Approach to Open Banking.

Open banking can be a game-changer for Africa, but it must be adapted to the continent’s unique realities. By leveraging data from mobile money, telecoms, and traditional banks, African countries can develop inclusive credit scoring systems that better reflect their populations’ financial behaviors.

Regional collaborations, like those in the EAC, CEMAC, and COMESA, can further enhance financial integration.

Next Steps: Governments and financial institutions should collaborate to create data sharing frameworks that respect privacy, promote transparency, and enhance financial inclusion.

Payments: Building Africa’s Own Swift and Card Schemes

PAPSS is a promising start, but Africa needs its own Swift-like system and card schemes that reflect the continent’s unique needs and challenges.

These systems should facilitate both intra-African trade and global transactions, empowering businesses and consumers alike.

The Way Forward: A pan-African payment system, built for Africa by Africans, would streamline commerce and provide a foundation for greater economic independence and innovation.

Interoperable Identity: The Foundation of Digital Economies

A robust digital identity framework is crucial for accessing financial services, government programs, and digital platforms. Africa’s digital ID systems must be secure, inclusive, and interoperable, enabling citizens to participate fully in the digital economy.

Blueprint for Success: Governments must prioritize the development of secure and interoperable digital identity systems across borders, laying the foundation for a truly digital Africa.

Conclusion: Interoperable Infrastructure is the Key to Africa’s Digital Future.

Infrastructure is the backbone of a digitally inclusive Africa, from internet cables and satellites to digital payment systems and agent networks.

By investing in these critical areas, African nations can build a resilient, inclusive digital ecosystem that supports innovation, empowers people, and drives sustainable economic growth.

Africa’s future lies in connecting its people, businesses, and governments through robust, inclusive infrastructure. The time to build is now.

The dream of a digitally interconnected Africa is within reach. By prioritizing interoperability and building a unified digital stack, we can unlock immense potential for financial inclusion, economic integration, and innovation across the continent.

A cohesive digital infrastructure, supported by national and regional collaborations, will empower millions of Africans to access and benefit from the digital economy, regardless of geographical boundaries.

This vision requires more than technological advancements; it demands collective action from governments, regulators, financial institutions, and innovators.

By harmonizing policies, investing in infrastructure, and fostering public-private partnerships, we can overcome the challenges that have long fragmented our markets.

A connected Africa is not just about seamless transactions or efficient data flows; it’s about creating a platform for shared growth, equitable opportunities, and sustainable development.

As we build the digital bridges that connect our diverse economies, we pave the way for a more inclusive, resilient, and prosperous Africa.

The time to act is now. Together, we can transform Africa into a global leader in digital innovation, setting a powerful example of how connectivity and collaboration can drive transformative change.