President Samia Suluhu Hassan’s formation of the Presidential Commission on Tax Reforms is a bold and strategic step to address Tanzania’s fiscal challenges and drive economic transformation.

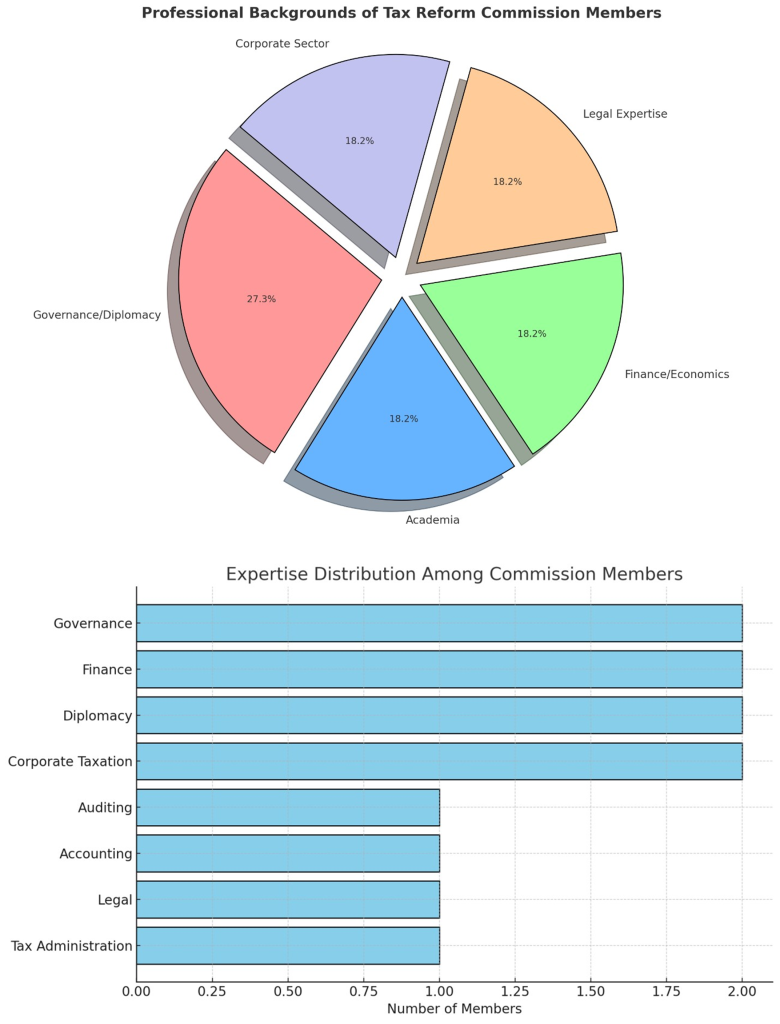

Comprising a blend of experienced professionals from governance, academia, finance, law, and the private sector, the commission is designed to provide a comprehensive approach to tax reform.

Each member brings unique strengths and perspectives, and a SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis offers valuable insights into their potential contributions and challenges.

Composition Review

Ambassador Ombeni Sefue, serving as chairperson, brings a wealth of experience in governance and diplomacy. As a former Chief Secretary and Permanent Representative to the United Nations, his leadership and negotiation skills make him adept at fostering consensus among diverse stakeholders.

However, his limited technical expertise in fiscal and tax matters may require heavy reliance on the technical acumen of other members. Nonetheless, his ability to maintain cohesion within the commission ensures a unified and effective approach to its broad mandate.

Prof. Florens Luoga, the former Governor of the Bank of Tanzania, contributes extensive knowledge of monetary policy and macroeconomic management.

His experience aligning fiscal and monetary policies is invaluable for ensuring that tax reforms support sustainable economic growth.

However, his focus on macro-level strategies might lead to gaps in addressing grassroots tax administration challenges. Prof. Mussa Assad, a former Controller and Auditor General, is a staunch advocate for fiscal accountability and transparency.

His experience in auditing and uncovering inefficiencies positions him to address systemic tax leakages.

ALSO, READ: Tax Reform in Tanzania: A Blueprint for Economic Equity and Growth

While his focus on auditing may limit his proactive policy contributions, his integrity and commitment to addressing fiscal gaps are assets to the commission.

Ambassador Maimuna Tarishi, with her diplomatic expertise and experience in governance, plays a vital role in stakeholder engagement and public relations.

Her negotiation and mediation skills will be critical in ensuring various stakeholders accept the commission’s proposals. However, her limited expertise in tax systems means she will rely on other members for technical guidance.

Similarly, CPA Aboubakar Mohamed Aboubakar, an academic and expert in accounting and auditing, brings crucial insights into harmonizing tax policies between Zanzibar and mainland Tanzania.

His experience with informal economies can help broaden the tax base, though his academic focus may require practical adaptation for large-scale implementation.

Ambassador Mwanaidi Sinare Maajar, a retired diplomat and legal expert, provides essential legal oversight to ensure that the commission’s proposals comply with regulatory frameworks and international best practices.

While her expertise lies outside fiscal policy, her contributions are vital for ensuring the enforceability and credibility of the reforms.

From the private sector, Mr. Leonard Mususa and Mr. David Tarimo bring invaluable experience in corporate taxation and business-friendly fiscal policies.

Mususa, the former CEO of PricewaterhouseCoopers Tanzania, has a strong track record of simplifying tax systems to attract investment.

However, his corporate focus could risk overlooking the need for equitable taxation.

Tarimo, a seasoned tax advisor, ensures pragmatic, implementable solutions but might prioritize corporate tax optimization, which could conflict with revenue-raising goals for broader public benefit.

Finally, Mr. Rished Bade, a former Commissioner General of the Tanzania Revenue Authority, brings firsthand experience in tax administration and revenue collection.

His deep understanding of Tanzania’s tax system positions him to address inefficiencies and enhance collection methods.

However, his association with past TRA challenges might expose him to criticism, requiring him to focus on transformative reforms to regain public trust.

The commission represents a well-rounded team of experts uniquely equipped to address Tanzania’s multifaceted tax challenges.

With diverse expertise spanning governance, legal frameworks, economic policy, and corporate taxation, it is well-positioned to deliver a comprehensive and balanced approach to reform.

While individual members may face challenges within their specific areas of specialization, their collective strengths, enhanced through collaboration and shared insights, are expected to yield impactful and actionable recommendations.

These efforts can be further reinforced by leveraging support from technical advisors or a dedicated secretariat, ensuring equitable contributions from all members and aligning their work with the mandate the President’s Office sets forth.

Terms Of Reference

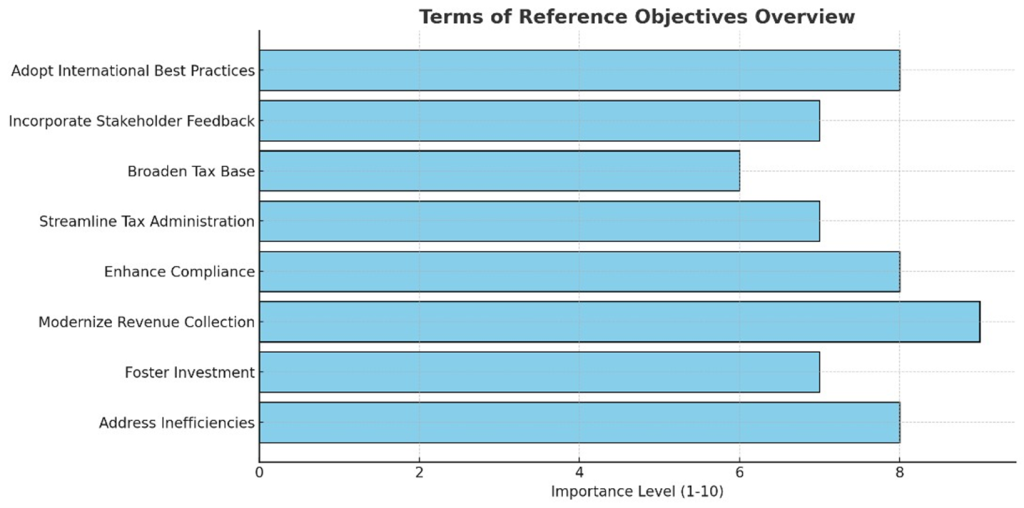

The Commission’s Terms of Reference (TOR) were designed to address critical gaps and inefficiencies within Tanzania’s tax system, ensuring it supports its broader socioeconomic goals.

The primary objective was to thoroughly analyse existing tax policies and laws to identify improvement areas, focusing on creating a more equitable, efficient, and growth-oriented tax framework.

Recognizing the significant influence of tax rates on various economic sectors, the Commission evaluated their impact on fostering a conducive environment for investment and productivity.

A review of tax and non-tax revenue collection systems and methods was included to modernize and streamline revenue generation, addressing issues such as inefficiencies, evasion, and administrative bottlenecks.

Further, the TOR emphasized examining the management and enforcement of tax laws to enhance compliance and governance while also exploring the effects of non-tax revenue on key productive sectors.

The Commission was also directed to identify and address challenges hindering the performance of tax collection authorities, including regulatory bodies and local governments, thereby improving institutional effectiveness.

To ensure the recommendations were inclusive and practical, the TOR mandated collecting and analysing feedback from citizens and stakeholders, bridging the gap between public needs and policy formulation.

Learning from international best practices was also prioritized to incorporate proven strategies from other countries.

Ultimately, the Commission’s work aimed to culminate in a comprehensive report with actionable recommendations, laying the foundation for a tax system aligned with Tanzania’s developmental aspirations.

This approach was chosen over others to holistically address systemic issues, leveraging domestic insights and global expertise for maximum impact.

Case Studies

Several real-world case studies from other regions illustrate the necessity for Terms of Reference (TOR) like those outlined for Tanzania’s tax reform commission.

In Ghana, challenges with mobilizing tax revenue due to inefficient collection, a large informal sector, and widespread tax evasion led to the establishment of the Ghana Revenue Authority (GRA) in 2009.

This initiative aimed to consolidate tax processes, improve compliance, and modernize tax administration, highlighting the importance of assessing tax systems comprehensively.

Similarly, Kenya faced low VAT compliance and difficulties taxing its vast informal economy.

The VAT reform of 2013 simplified tax brackets, broadened the base, and reduced exemptions.

Kenya Revenue Authority (KRA) also introduced presumptive taxes and education programs to integrate the informal sector, showcasing the value of stakeholder engagement and revenue system reviews.

A fragmented structure with multiple indirect taxes characterized India’s pre-2017 tax system. The Goods and Services Tax (GST) was introduced to address this, unifying indirect taxation, simplifying compliance, and expanding the tax base.

This reform, supported by extensive consultations and international benchmarking, reflects Tanzania’s objectives to analyze tax laws and adopt best practices.

In South Africa, post-apartheid reforms targeted the unequal tax system, focusing on integrating small businesses and informal workers while enhancing the South African Revenue Service (SARS).

This process demonstrated the importance of addressing tax authority performance and engaging stakeholders, aligning with Tanzania’s goals.

Uganda, facing a low tax-to-GDP ratio due to outdated methods and non-compliance, tasked the Uganda Revenue Authority (URA) with modernizing its processes through digital tools, legal revisions, and international knowledge exchange.

These efforts illustrate the relevance of benchmarking and modernization to Tanzania’s TOR. Lastly, the Philippines, grappling with a complex and regressive tax system, launched the Comprehensive Tax Reform Program (CTRP) in 2017.

The program simplified tax laws, introduced progressive taxation, and strengthened tax administration, underpinned by public consultations and stakeholder input.

These case studies collectively highlight the critical importance of systematic reviews, modernization, and inclusive engagement in tax system reforms, underscoring the relevance of

The President’s Office spearheads Tanzania’s TOR. As the central authority responsible for steering national development, upholding accountability, and driving policies aligned with Tanzania’s socio-economic goals, the President’s Office is pivotal in ensuring the TOR addresses the country’s unique challenges.

The TOR embody a strategic vision that integrates the government’s broader objectives of fostering economic growth, promoting equity, and building a tax system that supports sustainable development while ensuring transparency, efficiency, and inclusivity in its implementation.

Challenges

Implementing the Terms of Reference (TOR) for Tanzania’s Tax Reform Commission will likely face several challenges.

Analyzing existing tax policies and laws can be complicated by outdated, overlapping, or contradictory regulations and incomplete or unreliable data.

Political resistance from influential groups benefiting from the current system could further complicate reform efforts.

Evaluating rates and their economic impacts is another area fraught with difficulties, as changes may have unintended consequences, such as discouraging investment or overburdening vulnerable sectors.

Resistance from businesses and limited capacity to model and predict the effects of rate adjustments also pose significant hurdles.

Modernizing revenue collection systems may encounter technological and infrastructural barriers, with resistance to adopting digital tools and inadequate technical expertise within tax authorities slowing progress.

The high costs of implementing these changes, including technology upgrades and training, add another layer of complexity.

Enhancing law management and enforcement is equally challenging due to corruption and weak governance within tax administration, coupled with enforcement difficulties in the informal sector.

Amending or enacting new laws to support reforms could also face delays due to political and legal bottlenecks.

Assessing the impact of non-tax revenue mechanisms presents challenges related to data reliability and the risk of disproportionately harming productive sectors.

Coordinating these strategies with broader fiscal policies further complicates their implementation.

Addressing inefficiencies within tax collection authorities may face resistance from entrenched bureaucratic systems and resource constraints, such as inadequate financial and human capital.

Collaboration between central and local authorities could also prove difficult.

Ensuring comprehensive stakeholder engagement and feedback integration requires overcoming low public awareness and representation gaps, particularly among marginalized groups.

Balancing diverse perspectives while maintaining momentum in the reform process could delay implementation.

Benchmarking international best practices, though valuable, may face adaptation challenges due to Tanzania’s unique context. Limited resources and potential misalignment with socio-economic goals may hinder the adoption of these practices.

Finally, developing comprehensive recommendations involves balancing interdisciplinary input and ensuring political buy-in for proposed reforms.

Translating these recommendations into practical, actionable solutions that address on-the-ground realities remains a significant challenge.

Overcoming these obstacles will require strategic planning, robust capacity building, effective stakeholder communication, and sustained political commitment to drive successful implementation.

Conclusion

This commission symbolizes Tanzania’s dedication to modernizing its system to meet the needs of a growing economy and population.

Under President Samia’s strategic leadership and the commission’s diverse expertise, it is poised to create a more efficient, equitable, and growth-oriented tax framework.

The well-defined Terms of Reference and the team’s balanced composition reflect a comprehensive approach to tackling critical issues such as broadening the tax base, enhancing compliance, and fostering a business-friendly environment.

While challenges may arise, the collective strengths of the commission and the integration of technical expertise with governance and diplomacy ensure practical and impactful outcomes.

This initiative aims to strengthen Tanzania’s fiscal health and sets a precedent for inclusive and innovative governance, paving the way for a more sustainable and equitable economic future.