The International Monetary Fund (IMF) recently released a list of top ten African countries with the highest debts, drawing attention to the ongoing challenges faced by many African nations in managing their debt burdens. Interestingly, Tanzania was excluded from this list, sparking discussions about its economic policies and fiscal management.

The IMF’s list of top ten African countries with the highest debts serves as a crucial barometer for assessing the economic health and financial sustainability of nations across the continent.

By highlighting the countries grappling with substantial debt burdens, the IMF aims to draw attention to the pressing need for effective debt management and sustainable economic policies. Importantly, this list also influences international perceptions of investment risk, foreign aid allocation, and credit ratings for these countries.

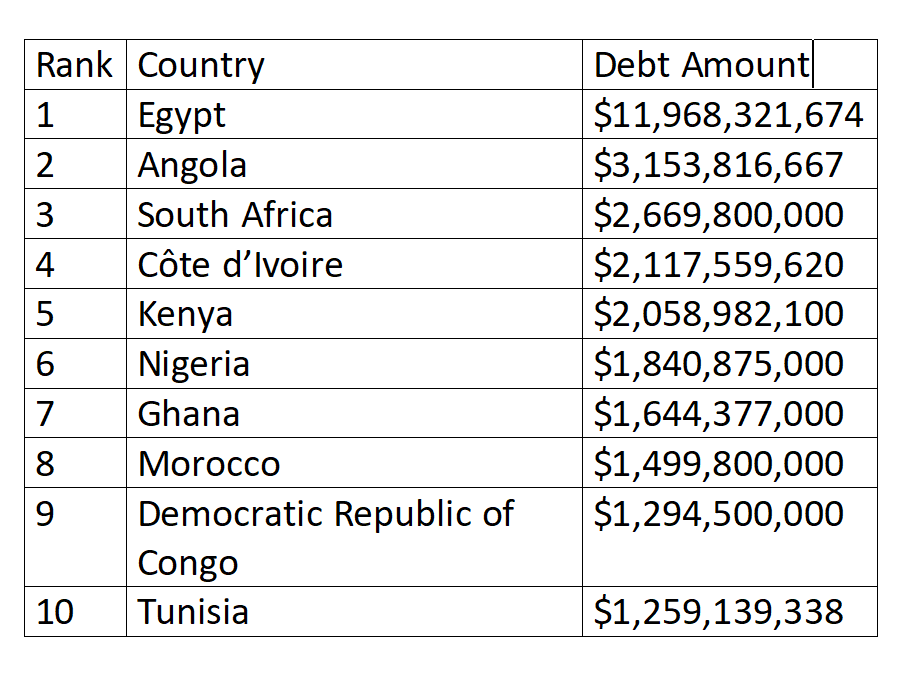

Current Statistical Data

The 10 African countries with the highest debts to the IMF, courtesy of the IMF’s official website as of 6th of December 2023. The top 10 African countries with the highest external debts include Egypt, Angola, South Africa, Côte d’Ivoire, and Kenya.

These nations have been navigating significant economic challenges exacerbated by the COVID-19 pandemic, which led to increased borrowing to mitigate the impact of the crisis on their economies. Conversely, Tanzania’s exclusion from the list might suggest relatively healthier debt dynamics and prudent fiscal management compared to its counterparts.

Implications of Tanzania’s Exclusion

Tanzania’s omission from the list of countries with the highest debts carries significant implications for the country’s economic reputation and financial prospects. It can be interpreted as a positive signal to investors and international financial institutions, indicating that Tanzania’s debt levels are more sustainable and manageable compared to its regional peers.

This could potentially bolster investor confidence and make Tanzania a more attractive destination for foreign direct investment, which is vital for fostering economic growth and development.

One can draw parallels between Tanzania and other African countries, such as Kenya, which has been grappling with a severe debt crisis. Kenya’s debt distress has led to challenges in servicing its debts, triggering negotiations with creditors and seeking support from international financial institutions.

In contrast, Tanzania’s exclusion from the IMF’s list highlights the potential benefits of sound fiscal policies and responsible debt management, which can shield a country from falling into the traps of unsustainable debt burdens.

Also read: IMF’s Vote of Confidence: Tanzania’s Economic Reforms and the Path to Prosperity.

Broader Context of Debt Management in Africa

The issue of debt management in Africa is multifaceted and interconnected with a range of economic, social, and political factors. Many African countries face the challenge of balancing the need for infrastructural development and social welfare programs with the imperative to maintain sustainable debt levels.

External borrowing has been a common strategy for financing critical development projects, but it also raises concerns about debt sustainability and the risk of default.

Addressing the issue of debt sustainability requires a holistic approach, encompassing fiscal discipline, transparent governance, and effective utilization of borrowed funds. Moreover, enhancing domestic resource mobilization and diversifying the economy can contribute to reducing reliance on external borrowing and enhancing a country’s financial resilience.

Current Efforts and Strategies

Some African countries have taken proactive steps to address their debt challenges by engaging in debt restructuring, seeking debt relief initiatives, and implementing fiscal reforms. Furthermore, the G20 initiative to provide debt relief for the world’s poorest countries has offered a pathway for eligible African nations to alleviate their debt burdens and redirect resources towards critical social and economic priorities.

Looking Ahead

As African countries continue to grapple with the economic fallout from the COVID-19 pandemic and navigate the complexities of debt management, there is a pressing need for sustained international cooperation, responsible lending practices, and innovative financial solutions. By fostering an enabling environment for sustainable economic growth and prudent debt management, African nations can chart a path towards financial stability and inclusive development.

Tanzania’s exclusion from this list underscores the potential benefits of prudent fiscal policies and responsible debt management, positioning the country more favorably in the eyes of international investors. However, it also underscores the broader imperative for African nations to adopt sustainable debt management strategies and foster economic resilience as they confront diverse challenges on the path to prosperity.

In summation, while the issue of debt remains a formidable challenge for many African countries, it also presents opportunities for meaningful reforms, strategic investments, and international collaboration to propel sustained and inclusive economic growth across the continent.

What is show ,What is depicts what this list suggested ? Does it show that unlisted are economically strong .