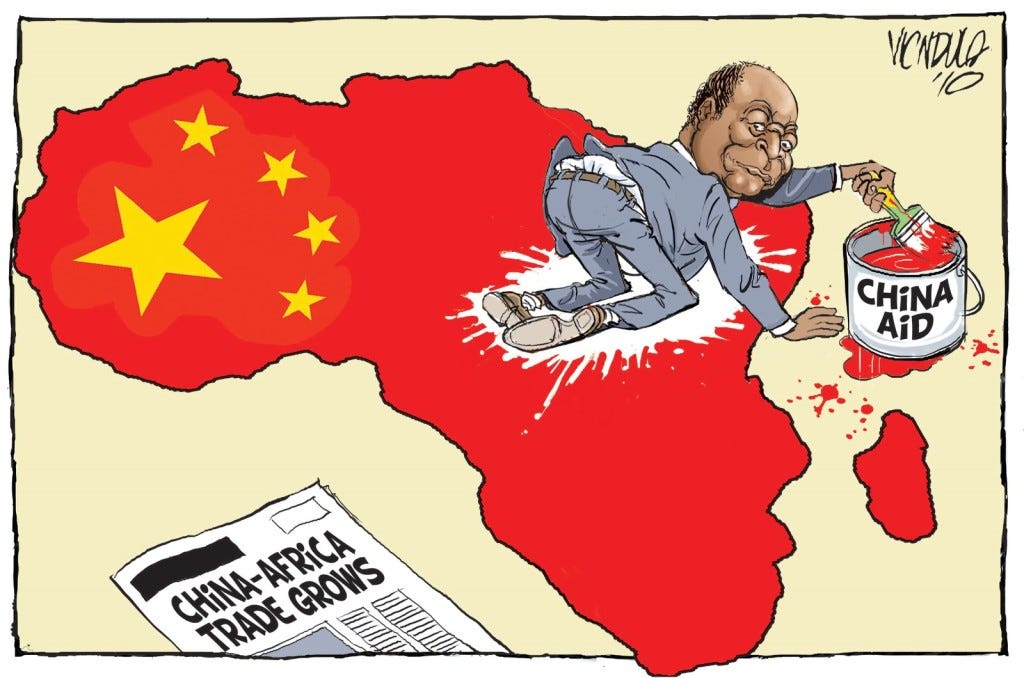

China relationship with Africa remains bullish despite tension caused by unpaid debt, burgeoning g trade deficit and declining China financing and economic growth.

China is angling Africa for solidarity and cooperation, and the Chinese supreme leader, Xi, categorizes “urgency matters” as something that many interpret as addressing challenges posed by recent geopolitical hostilities. This article looks at what is at the table between China and Africa.

According to China’s Foreign Ministry, the official FOCAC 2024 summit theme is “Joining Hands to Advance Modernisation and Build a High-Level China-Africa Community with a Shared Future”.

The summit comes when China is increasingly countering the influence of the United States and Europe in Africa and other developing regions in its climb to global superpower status.

Although the US, Japan, India, and Russia hold regular summits to woo the continent’s leaders, China is unmatched as the continent’s economic partner.

For Beijing, the African summit is an opportunity to flaunt its massive influence in the continent that is growing in influence globally. China is flexing muscles against the Western World over trade, climate change, the status of Taiwan, and having access to the mouthwatering 54 votes of African countries in the UN must be very reassuring to them.

China is expected to lure African leaders with more investment dollars and lobby for improved access to important minerals like lithium, copper and cobalt, which it currently mines in the Democratic Republic of the Congo (DRC), Zimbabwe, Botswana, and other countries.

READ RELATED: Why Tanzania Must Rethink Its Economic Dependency on China

Beijing will also likely push for more exports of its China-made products, particularly renewable energy products and technologies it has recently invested heavily in.

On the other hand, African countries, which often make bilateral deals, will look to clarify plans for some unfulfilled pledges from past summits. Some, like the DRC, will also seek more cooperation to ensure Chinese companies refine the raw materials they mine in the country. That approach will yield more revenue for these countries while providing more job opportunities for Africa’s young workers.

Last year, Zimbabwe imposed an export ban on unprocessed lithium, effectively forcing Chinese companies to process it there, churning out local jobs and technological transfer and adding value to exports.

The Chinese government has promised to increase its technological footprint in Africa by setting up vocational training colleges in South Africa as part of its strategic capacity building that will shift some manufacturing capabilities in Africa.

African governments are keen to shed her title of a source of cheap raw materials and labour to target more manufacturing roles that will put their jobless millions of youth into meaningful employment. China now tops India and the US as favourite destinations for higher learning, and China has promised to double up on scholarships available for African students to study in China.

China’s excess capacity is another flashpoint. Some are apprehensive that China may offload that to the extent of deflating African abilities to develop a domestic manufacturing base.

There is a proliferation of final product Chinese retailing taking root in many African countries, puncturing the capabilities of African initiatives to build domestic manufacturing factories and industries. Efforts to intertwine the massive Chinese manufacturing capacity relocation to Africa with the availability of cheap labour are an ongoing discussion.

Western governments have been quick to criticise the Belt- Road initiative, which has condemned many African governments into a debt trap, defaulting from honouring their debt burden. China has countered those claims by comparing how Wall Street investors have bought African bonds ballooning their debts.

However, Chinese public banks have been cooling down on lending to African governments amid concerns of hurting their own balance sheets following the ramifications of defaulting.

Chinese banks have agreed this year with other lenders under the G-20 initiative to restructure debts of Zambia, Ghana and Ethiopia. Chinese lending to Africa topped to USD 4.6 billion, a notable uptick since 2016.

ALSO READ Tanzania’s 2024/25 Budget: A Glitzy Reveal, Grand Show! But What’s the Plan?

Lending is waning due to the inability of African governments to repay past loans, but also the Chinese government’s insistence on smaller, strategic projects to reduce the risk of loan repayment defaults.

In the Common Framework arrangement set up by the G-20, lending governments must renegotiate debt write-offs with the indebted African governments before negotiating similar favourable terms with private lenders, including International Banks and bondholders.

The China-African initiative will soon have its own stern test as Africa transits to renewable energies to power her homes and industries. How much will China support Africa in weaning her from cheap imported solar and wind equipment to homemade ones where local jobs, technological transfer, and added value are most assured?

The Chinese economy is bracing through some hardships of its own, with real estate showing signs of bursting the bubble economy that was massively funded by loans. Those loans are now unpayable after the underlying assumptions of stimulating artificial demand failed to materialize.

Government bailouts have been a proven way out to defer contradictions that haunt and stalk all small and medium economies, transforming into major ones. Overambition does it!

Chinese companies in Africa, particularly those involved in construction industry, have begun meddling and interfering in the local elections, eroding the sovereignty of the countries in question.

In the Tanzanian case, the recent donation of a chopper to the ruling party CCM bucks topped with running costs’ bootleg triggered disturbing concerns about why the Chinese contractors see its importance.

Knowing that a large portion of the domestic budget dedicated to construction is allocated to Chinese construction companies, one can easily see the ties between them and those who award those jobs impress more and more as a “pay to play” kind of symbiotic association.

Paradoxically, the ability of African governments to clear their debt burden is also tied to how their individual economies perform, and spiking the local manufacturing base, transiting into cleaner technologies to blunt operational costs, could be a gigantic step towards the right direction.

African natural resources are being eyed by the whole world, which is not bad if the relationship is mutually beneficial to both sides.

That is possible if Africa ceases to be a source of cheaper commodities and labour but becomes a major player in the production of final products.

This is a challenging task because it means the developed World must accept a change of development paradigm that may be unpopular in their own countries. However, technological breakthroughs and demands imposed by population growth in Africa will pivot all of us into new, mutually beneficial engagements.